Latest Posts On Payments

Building vs. Buying Payment Infrastructure: The True Cost Analysis for African Fintech Startups

May 5, 2025

Why IntaSend Is Now the Best PayPal Alternative in 2025

Mar 21, 2025

Cross-Border Payments vs. Remittance: Key Differences 2025

Mar 19, 2025

Cross-border Payment Strategies for E-commerce Businesses

Mar 18, 2025

Gross vs. Net Salary: Streamlining Payroll with IntaSend

Mar 14, 2025

How to Calculate Gross Profit: A Simple Guide for Business Growth

Mar 11, 2025

How to Withdraw Money from an ATM in Kenya

Mar 10, 2025

IntaSend Unveils Cross-Border Payments in 7 New African Markets

Feb 26, 2025

Simple Pay Capital: A Quick Guide to Business Growth Funding

Feb 18, 2025

How to Send Money From M-PESA to Airtel Money

Feb 7, 2025

How to Withdraw Money from Airtel Money to M-PESA: A Complete Guide

Jan 31, 2025

Google Pay: A Simple Guide for Kenyan E-commerce Businesses

Jan 23, 2025

How to Accept Google Pay in Kenya [2024] : A Complete Guide

Jan 20, 2025

Hosting Provider Solutions: Choosing the Right Partner

Jan 16, 2025

Why Tours and Travel Agencies Need a Payment Gateway

Jan 15, 2025

Marketing Tours and Travel Hidden Gems: Effective Tips

Jan 15, 2025

Best Tours and Travel Destinations in Kenya: Hidden Gems

Jan 14, 2025

Digital Wallet Dominance in E-commerce Transactions

Jan 10, 2025

Mobile Banking Apps in Kenya: Your Pocket Financial Assistant

Jan 6, 2025

Online Banking: A Complete Guide to Online Banking in Kenya

Jan 6, 2025

E-commerce Success: 2025 Back-to-School Tips and Trends

Jan 4, 2025

E-commerce Hacks for 2025: Boost Your Sales Like a Pro

Jan 4, 2025

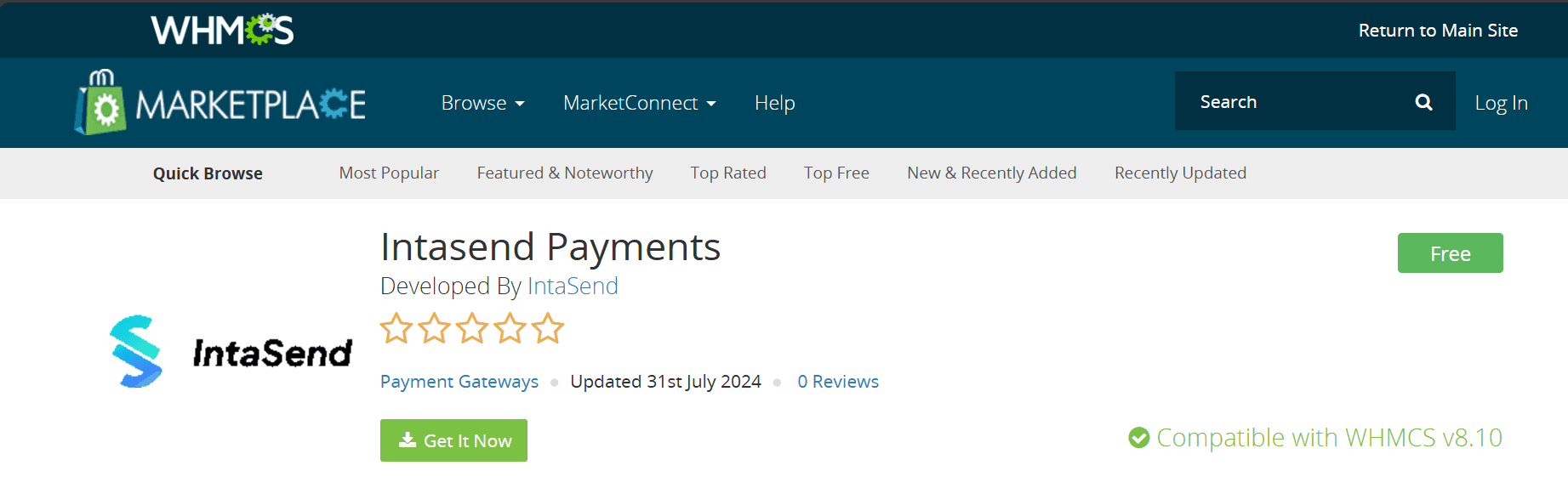

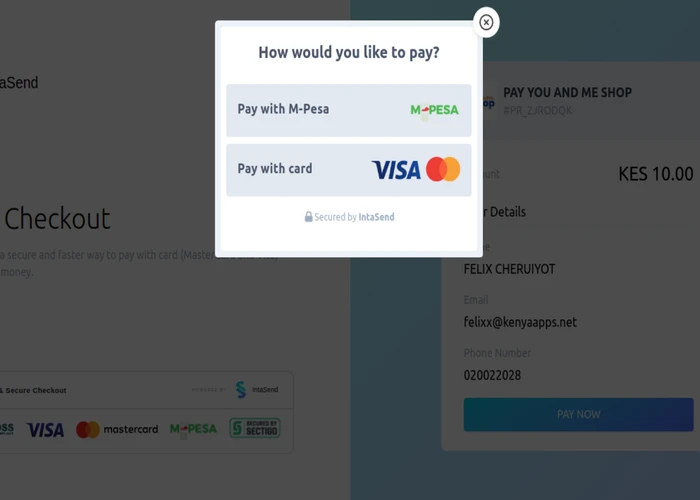

Understanding WHMCS: Streamlining Your Hosting Business

Jan 4, 2025

Freelancing as a Beginner: Your Ultimate Guide with IntaSend

Dec 10, 2024

Payment Solutions for Odoo: Receive payments securely in Kenya

Dec 9, 2024

PayPal to M-PESA: Withdrawal, Challenges & Best New PayPal Alternative

Mar 6, 2025

How to find the best Payment Gateway in Kenya for Online Payments

Nov 29, 2021

How to Choose A Digital Wallet Service Provider -15 Things to Consider

Dec 15, 2021

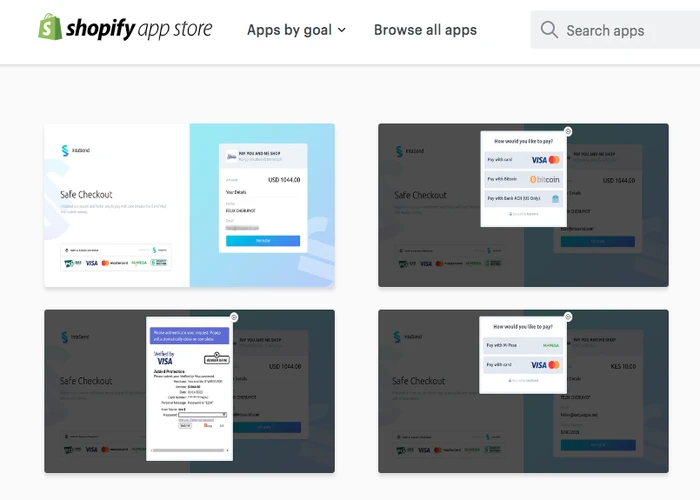

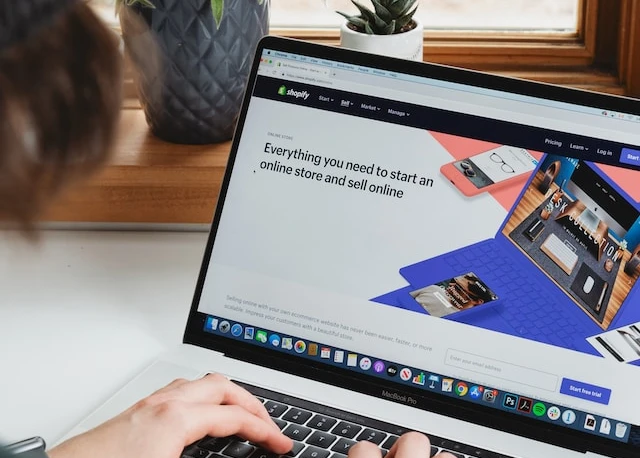

Shopify Payment Gateways in Kenya - How to Accept Payments on Your Shopify Store

Feb 19, 2022

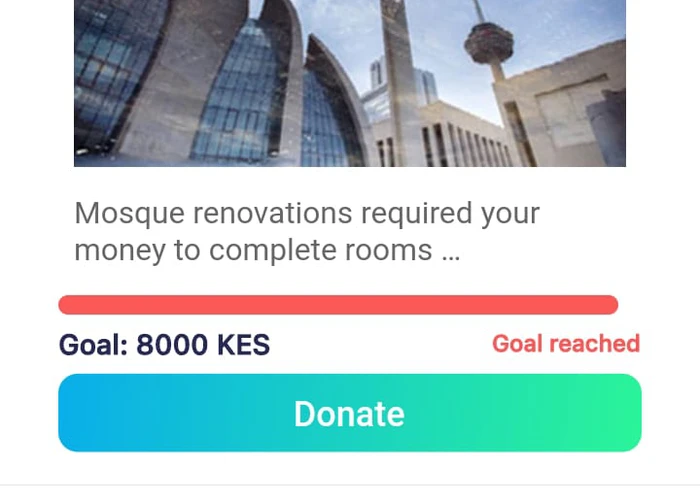

Online donation platforms for NGOs and Religious Organizations in Africa

Feb 27, 2022

Best Payment Gateway for WooCommerce

May 15, 2022

How to pay International Contractors - 5 Best ways

May 20, 2022

Cross-border Payment API: Everything You Need to Know

May 20, 2022

How to Get Paid Through Cash App In Kenya [Little-Known Hack]

May 24, 2022

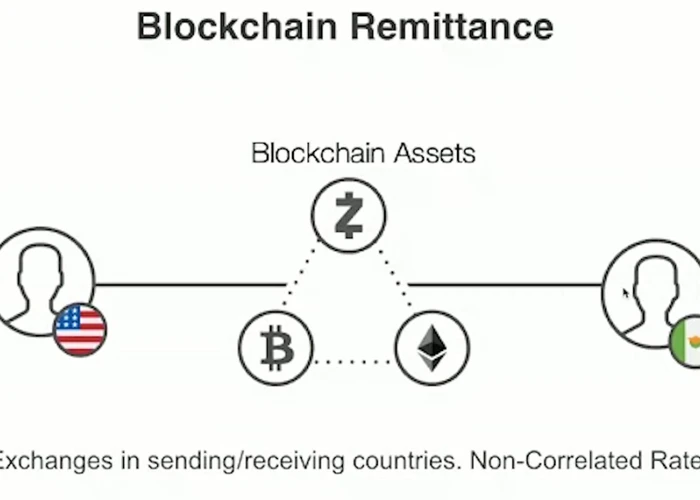

Cross Border Remittance and Mass Payouts: How to choose a provider and everything else

May 28, 2022

Payment Methods For Freelancers - How to pay and get paid

May 28, 2022

How to Politely Ask for Payment - With Examples

Payment Methods for Freelancers in Africa

Flutterwave payment gateway alternative, Flutterwave vs IntaSend

Jun 10, 2022

Why You Should Use A Global Payroll Payment Processor: The 3 Reasons

Jun 10, 2022

What is a payment gateway, and how does it work?

Jun 11, 2022

3DS2 (3D Secure 2.0) - Everything You Need to Know

Jun 12, 2022

How to Set Up Payment Gateway for Your Ecommerce Website

How to Choose a Cross-Border Payment Platform and API

Dec 4, 2024

The Alternative to PayPal: Accepting Card Payments Online

Jun 27, 2022

How to Create Professional Invoices That Get You Paid

Jun 29, 2022

How to Pay Freelancers and International Contractors

Jun 29, 2022

Wallet As A Service API - 9 Best Use Cases

Jul 14, 2022

PayPal MPesa - How To Get Paid Online With IntaSend

What is an EOR? [How to Hire Remotely & Make EoR Payments]

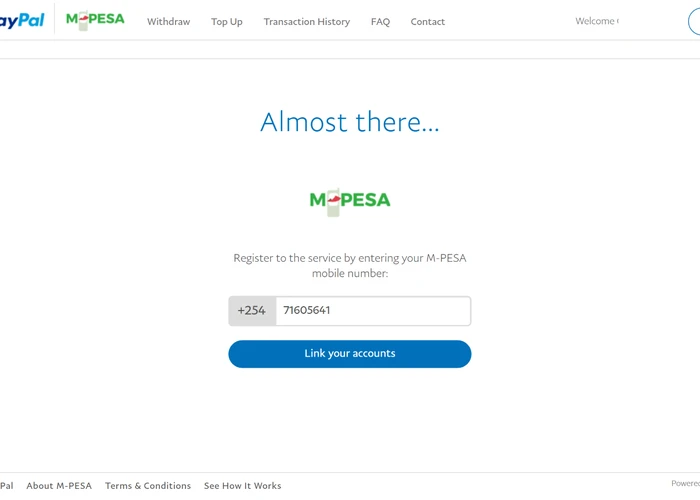

PayPal to M-Pesa - How To Link and Withdraw From Your PayPal In Kenya

Jul 25, 2022

PayPal Withdrawal: Which Banks Are Linked to PayPal in Kenya

Aug 7, 2022

The Best Payment Gateway in Kenya - IntaSend

Aug 7, 2022

How To Accept Credit Card Payments on your Website

Aug 8, 2022

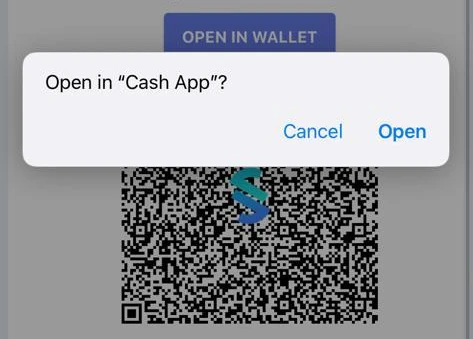

Can You Use Cash App In Kenya? [Yes, But Not Directly]

Aug 13, 2022

M-Pesa API Integration - Step-by-step Guide

Aug 13, 2022

The Best Payment Solutions For Freelancers: Top 3 providers

Aug 15, 2022

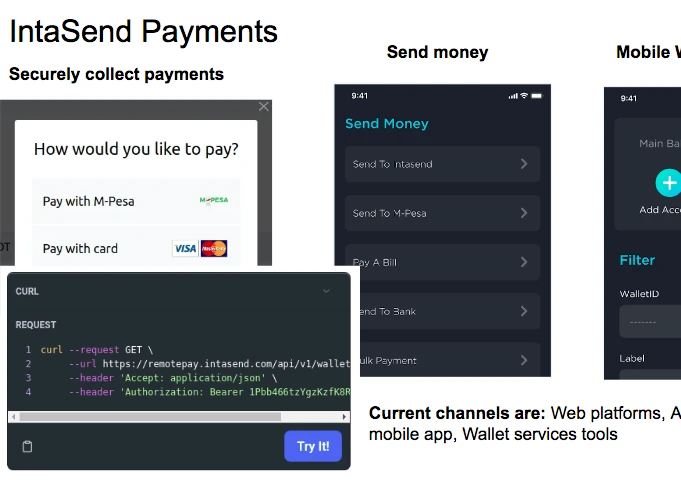

Payments API for Developers - IntaSend

Aug 20, 2022

Shopify M-Pesa Integration - How to Accept M-Pesa Payments On Your Online Store

Aug 26, 2022

Top 5 Online Payment Platforms to Use in Kenya

Aug 26, 2022

Payment Gateway without Company Registration : How to get started

Aug 29, 2022

How to Setup a Shopify Payment Gateway

The Best Wallet Service Provider - Why IntaSend? How does it Work?

Wallet As A Service and Financial Inclusion

Sep 6, 2022

Payment Gateway API - IntaSend

Sep 11, 2022

WooCommerce Payment API - Complete Guide

Sep 15, 2022

M-PESA B2B API Integration - The Best Way to Integrate M-PESA B2B in Your Business

Sep 16, 2022

How To Choose The Right API Payment Solution For Your Business: A Complete Guide

Sep 17, 2022

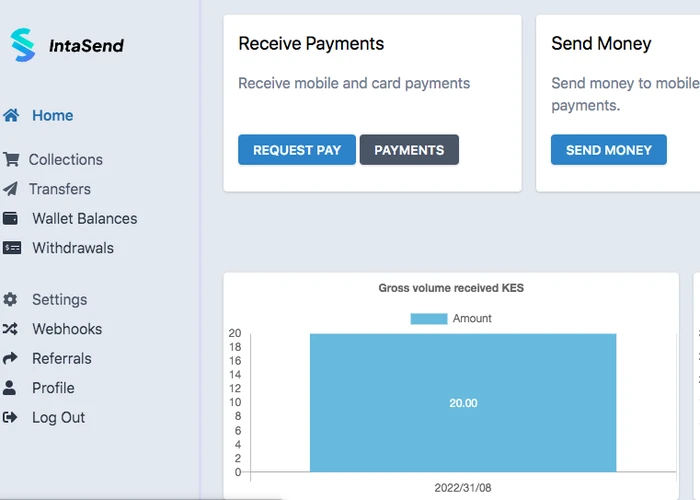

IntaSend Payment API For Developers - Use cases and how to get started

Sep 26, 2022

The Complete Guide To Payment Gateway APIs in Kenya

Sep 27, 2022

Payment Gateway API - Send And Receive Money with IntaSend

Sep 27, 2022

How To Integrate A Checkout Process Into Your Website: The Ultimate Guide To Selling Online

Bank Transfer API - The Ultimate Guide

7 Reasons Why You Should Choose IntaSend As Your Online Payment API Provider In Kenya

Oct 7, 2022

Digital Wallets APIs - The Future of Payments and Interoperability in Africa

Nov 12, 2022

Create Your PayPal Account In These Simple Steps

Dec 4, 2022

Quickbooks Online and Creating Invoices - 10 Things You Need To Know

Dec 4, 2022

Creating An Invoice Template In Quickbooks - Complete Guide

Dec 5, 2022

Africa’s Best Payment Platform For Freelancers

Dec 7, 2022

PesaLink API - How To Get Started and Everything You Need For Bank Transfers In Kenya

Dec 10, 2022

What is 3D Secure 2.0? Everything You Need To Know

Dec 16, 2022

What is Cash App and How Can Africans Use It?

Dec 16, 2022

Point of sale software for small businesses in Kenya

Dec 16, 2022

How to Pay Freelancers in Kenya

Dec 16, 2022

The Best Payment Solutions For Travel Agencies in Kenya

Dec 16, 2022

5 Best Rental Management Systems in Kenya

Dec 20, 2022

Tracking Western Union Payments in Kenya

Dec 28, 2022

Cheapest Ways To Receive Payment For Freelancers In Kenya

Dec 28, 2022

How to Pay NHIF Contributions Via M-Pesa - The Ultimate Guide

Dec 29, 2022

M-Pesa-Bank Transfers in Kenya

Dec 29, 2022

What Can You Do With the M Pesa App?

Dec 29, 2022

IntaSend - Airtime API for Developers

Dec 29, 2022

Automated Salary Disbursement- Revolutionizing Payroll

Jan 27, 2024

Money Laundering in Kenya - the Role of Digital Payments

Top 5 Money Apps in Kenya

Money Transfer Services - The Best in Kenya

Leveraging Digital Payments to Drive Economic Growth in Kenya

Feb 6, 2023

Innovations in Payment Systems: How They’re Transforming Kenya’s Banking Industry

Feb 12, 2023

Top Card Payment Errors and How to Solve Them

Feb 6, 2023

B2B API Integration - How to automate payments full guide

Feb 12, 2023

How to Choose the Right Payment Gateway API

Feb 6, 2023

Quickbooks Online - Getting Started and automate payments

Feb 12, 2023

How to Create a Professional Proforma Invoice

Feb 6, 2023

How to Securely View Payslip Online

Feb 7, 2023

New MPesa Transaction Charges 2023

Mar 16, 2023

Popote Pay Alternative - IntaSend Payments

Feb 18, 2023

How to File KRA Returns Online in 2023

Feb 7, 2023

Severance Pay in Kenya: What It Is & How to Calculate It

Mar 7, 2023

Skrill to M-Pesa: How to Withdraw Your Money

Mar 7, 2023

Alternative to Zelle for Sending Money to Mpesa in Kenya

Feb 7, 2023

Payoneer to M-Pesa - Payoneer Features, Benefits & Best Alternative in Kenya

Feb 7, 2023

The Best Fiverr Payment Alternative for Small Businesses

Mar 8, 2023

How to Calculate Income Tax in Kenya: 5-Step Guide

Feb 12, 2023

SMEs in Kenya: Meaning, Characteristics & Economic Benefits

The Ultimate Guide to Mobile Wallets: What They Are and How They Work

Feb 16, 2023

Payment Button - How to revamp Your Website and Increase Sales

Feb 17, 2023

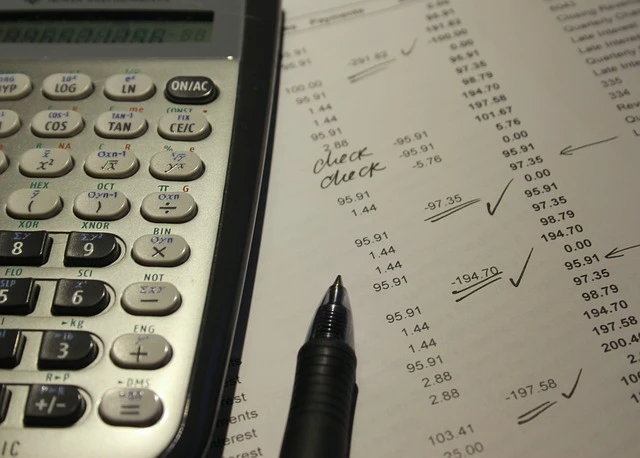

Bookkeeping Basics for Small Businesses

Feb 20, 2023

Top 5 Features to Look for in an Invoice Generator Tool

Mar 8, 2023

What Is a Cash Flow Statement and Why Is It Important?

How to Integrate Your eCommerce Platform with ERP

How a Balance Sheet Can Help You Make Informed Financial Decisions

19 Groundbreaking Business Online Trends in 2023

Mar 7, 2023

Understanding Your Financial Situation Through Budgeting

PesaLink for Business: How to Streamline Your Financial Transactions

Mar 8, 2023

How to Integrate MPesa API - A Step-by-step Guide

Feb 26, 2023

Salary Advance Loans in Kenya - Requirements, Limits & 7 Top Providers

Mar 16, 2023

A Guideline to Choosing Payroll Services in Kenya

Feb 26, 2023

Currency Exchange Rates in Kenya Today

Mar 10, 2023

Understanding Invoice Factoring: A Guide for Small Business Owners

Mar 6, 2023

How to Choose the Right Niche for Your Online Business

Mar 6, 2023

What is a Credit Note and How Does it Work?

Mar 10, 2023

Attachment Report: What is it and Why it’s Important

Mar 6, 2023

The Best Platform to Find Online Writing Jobs

Mar 19, 2023

Payoneer vs. IntaSend: Which One Should You Use for Your Business?

Mar 19, 2023

5 Roles of the Central Bank of Kenya in the Country's Economy

Mar 19, 2023

A Beginner’s Guide to Choosing the Best Payment Gateway in Kenya

Mar 19, 2023

9 Benefits of Using a Payment Processor for Your Business

Mar 19, 2023

The Pros and Cons of Different Online Payment Methods

Mar 19, 2023

How NHIF Online Is Making Healthcare More Accessible in Kenya

Mar 19, 2023

5 Tips For Streamlining Your Bill Payment System

The Ultimate Guide to Registering a Business in Kenya

5 Ways Business Automation Can Improve Customer Experience

Ecommerce Payment System: 5 Must-have Security Features

How to Choose the Right Online Payment Service for Your Business

What Is The Difference Between Shopify And WordPress?

May 24, 2023

How to Accept M-Pesa Payments On Your WordPress Site In Kenya

May 26, 2023

How to Pay for Dstv Online in Kenya [Quick Guide]

May 28, 2023

Subscription Payments in Kenya: Manage Recurring Payments

May 30, 2023

Pay On Delivery Online Shopping in Kenya: Guide for Merchants

Jun 4, 2023

Sim Swap Fraud in Kenya - Mobile Money Security

Jul 13, 2023

M-Pesa Tricks - A Guide On Mobile Wallet Fraud

Jun 9, 2023

How to Report M-Pesa Fraudsters

Jun 18, 2023

How to Get a Virtual Visa Card in Kenya

Jun 24, 2023

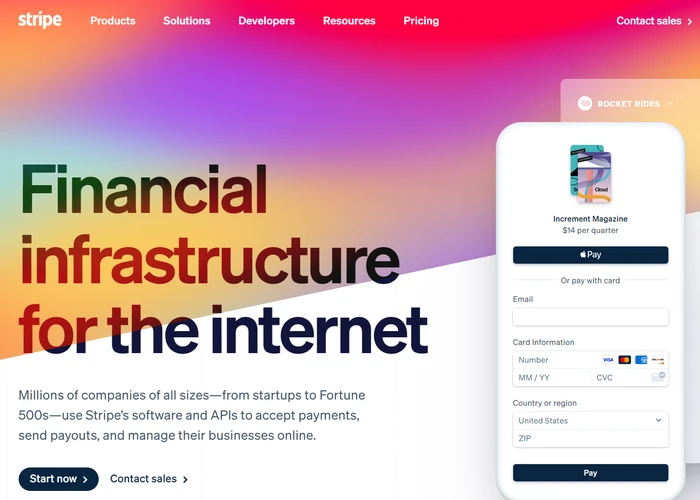

Is Stripe Available in Kenya? [+ Best Alternative in Kenya]

Jun 29, 2023

What is a 2d Payment Gateway? [+Best Alternative In Kenya]

Digital Wallet vs Mobile Wallet - What Are Their Differences?

How to Choose Online Payment Methods to Accept in Kenya (Guide for Merchants)

Jul 5, 2023

GDPR in Kenya - A Guide for E-Commerce Merchants

Jul 12, 2023

How to Get the M-Pesa GlobalPay Virtual Visa Card

Jul 12, 2023

Does Youtube Pay Through M-Pesa? [+ A Viable Local Withdrawal Method]

Jul 17, 2023

Payment Processor vs Payment Gateway - Differences & Examples

9 Benefits of Online Payments for Businesses in Kenya

Jul 25, 2023

How to Receive Money From the USA to Kenya [Through M-Pesa]

Jul 27, 2023

Best PayPal Alternative In Kenya

Sep 27, 2024

How to Choose a Payment Gateway - Guide for Merchants in Kenya.

Aug 9, 2023

How Online Payments Work for Internet-Based Businesses

Aug 8, 2023

Debit Card Fraud: Can Someone Use Your Debit Card Without Having It?

Aug 10, 2023

Does PalmPay Work In Kenya?

Subscription Business Model: What It Is, How It Works & Examples in Kenya

Sep 29, 2023

What Are The Benefits of Fintech Payments in Business?

9 Subscription Business Model Ideas To Try In Kenya

Oct 5, 2023

Are Subscription Box Businesses Profitable? [Top 4 Reasons for Failure]

Oct 9, 2023

Do People Actually Buy Subscription Boxes?

Oct 10, 2023

Subscription Billing - Definition & How to Choose the Right Pricing Model

Oct 16, 2023

Subscription Management - Meaning, Components & How to Automate It

Oct 18, 2023

10 Benefits of Using Subscription Management software.

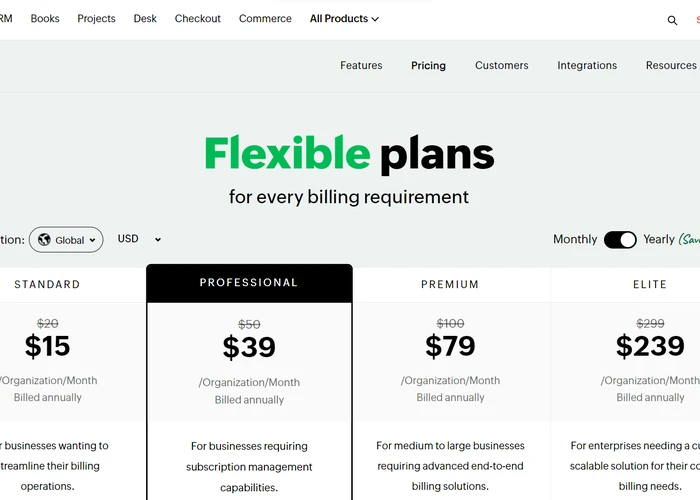

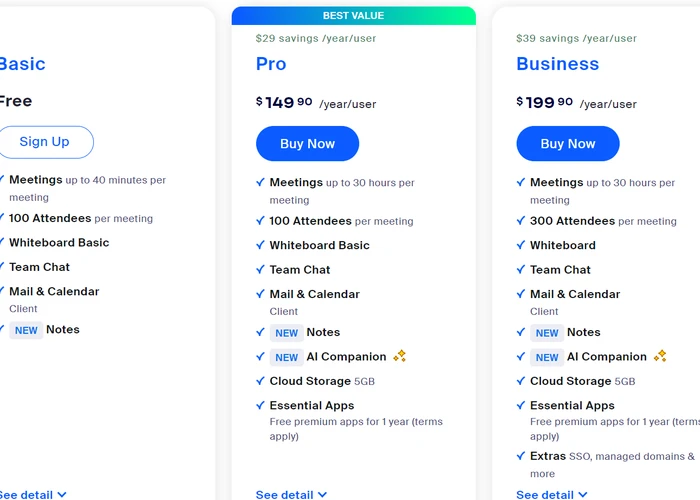

How to Choose Software for Subscription Management - Guide

Oct 24, 2023

Subscription-Based Software - Definition, Business Case & Examples.

Subscription Pricing Strategy: How to Price Your Subscription Service.

What Is A Subscription Plan?

Nov 6, 2023

Is The Subscription Model Right For Your Business?

Nov 13, 2023

Can You Sell Subscriptions On Shopify? [Guide]

Nov 15, 2023

Billing Automation - Meaning, How It Works & 9 Benefits for Businesses

Nov 16, 2023

Subscription Billing vs Recurring Billing - What’s The Difference?

Nov 18, 2023

How to Automate Billing And Get Paid Faster

7 Most Common Billing Mistakes And How To Avoid Them

What Is The Billing Process? [Steps, Purpose & Tips]

Nov 25, 2023

Dunning Automation - Meaning & Impact On Revenue Recovery

Nov 29, 2023

9 Must-Have Elements Of A Good Billing System.

Nov 29, 2023

How Billing Automation Can Improve Cash Flow

Dec 6, 2023

Subscription Marketing - How to Promote Your Subscription Product

Dec 11, 2023

Disbursements: Meaning, Purpose & How to Streamline Them

Jan 10, 2024

Mastering Salary Disbursements: Automation and Efficient Payment Methods

Jan 15, 2024

E-Payments Explained - Meaning, Types & Benefits for Businesses.

Jan 15, 2024

What Happens If A Company Can't Make Payroll?

Jan 17, 2024

Payroll Errors: What They Are, Causes & Fixes

What Is The Difference Between Company Payroll And Third Party Payroll?

Who Is Responsible For Payroll Errors?

Jan 24, 2024

Payment Aggregator vs Payment Gateway - A Quick Explainer.

Disbursement vs Payment: How Do They Differ?

What Information Do Employers Need For Payroll

Feb 4, 2024

Subscriptions And Memberships - Unpacking The Differences

Feb 6, 2024

Free Trial Pricing: Low-Cost Customer Acquisition Strategy for Subscription Businesses.

Feb 7, 2024

What Is A Digital Disbursement? [Why You Must Care]

Feb 14, 2024

Expenses vs Disbursements. What Are Their Differences?

Feb 17, 2024

Are Disbursements Taxable in Kenya?

Feb 20, 2024

Scheduled Payments: What They Are & Why You Should Use Them.

Loan Disbursements: Definition, Examples & Use Cases.

What Is The Freemium Revenue Model? (Pros, Cons & Use Cases)

Feb 24, 2024

Pay-Per-Use Billing Model - Meaning, How It Works & Examples

Feb 28, 2024

Product-As-A-Service Business Model: Everything You Need To Know

What Is Recurring Revenue? [+ 5 Ways To Create It]

Mar 6, 2024

Circular Economy: What It Means For Businesses & Consumers

Mar 6, 2024

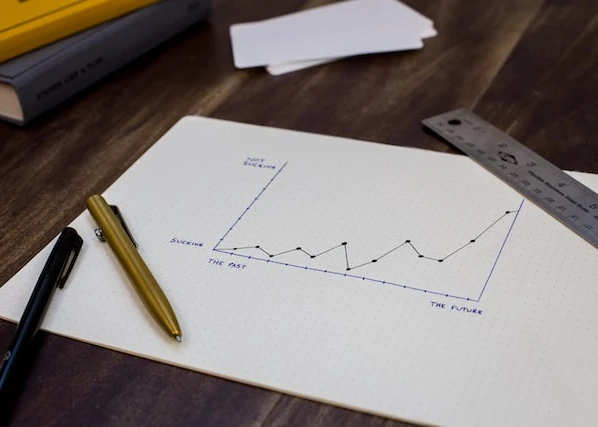

How To Calculate Annual Recurring Revenue (ARR).

Mar 7, 2024

5 Product-As-A-Service Examples & Companies Using The Model

Mar 7, 2024

Payroll Management Accuracy: How Do You Measure It, Why & Using What Metrics?

Mar 29, 2024

Recurring Revenue vs Reoccuring Revenue - Unpacking The Differences?

Apr 4, 2024

Net Revenue Churn: Its Meaning, Calculation & Impact.

Apr 6, 2024

How To Get A Virtual Mastercard Debit Card in Kenya?

Apr 6, 2024

Attrition Rate vs Churn Rate - Significance For Subscription Businesses.

Apr 10, 2024

How To Increase Subscription Sales - 5 Proven Strategies.

Apr 10, 2024

PCI Compliance For Merchants - How To Reduce Card Fraud & Boost Cybersecurity.

Apr 10, 2024

What Is Expansion Revenue? [+6 Ways Ways To Drive It]

Apr 10, 2024

How To Collect Recurring Payments The Right Way [7 Essential Best Practices]

Apr 10, 2024

Recurring Billing: When Can A Recurring Charge Be Applied?

Apr 10, 2024

How To Value A Recurring Revenue Business.

Apr 18, 2024

Gratuity Pay in Kenya: What Is It? Should You Pay It?

Apr 24, 2024

Are Salary Cuts Legal in Kenya? [What The Law Says]

May 8, 2024

Redundancy Pay in Kenya: Legal Meaning, Process & How to Calculate It

May 8, 2024

How to Set, Pay & Disburse Salaries in Kenya [A Legal Guide]

May 8, 2024

5 Top Reasons for Late Salary Payments [+How to Solve Them]

May 8, 2024

How to Calculate Leave Pay in Kenya.

May 8, 2024

Are Allowances Taxed in Kenya?

Oct 30, 2024

Is 13th Month Pay Mandatory in Kenya

May 8, 2024

How to Calculate Salary Scale in Kenya.

May 8, 2024

Salary Deductions in Kenya: How To Calculate Net Pay.

May 8, 2024

How Google Pay is Transforming Digital Payments in Kenya

Oct 18, 2024

Apple Pay: Transforming Digital Payments in Kenya

Oct 24, 2024

Shopify Account Suspended: Key Issues & Solutions for Kenyan Merchants

Oct 24, 2024