The Best Payment Gateway in Kenya - IntaSend

Aug 7, 2022

You need a capable payment gateway to accept payments for your online store or e-commerce website. Discover the best payment gateway in Kenya.

There was a time when finding a payment gateway focused on the Kenyan market was one of the challenges of setting up an online business.

Fast-forward to today, and the challenge is choice overload, which causes decision fatigue.

Are you struggling to decide the best payment gateway for your online store?

This article spotlights IntaSend and shows why it is the best payment gateway in Kenya. We will share why we decided to build it, how it works, and the benefits it brings.

To better understand the dynamics in the payments industry in Kenya, let's first look at the current landscape and trends.

The online payments landscape in Kenya

The mobile money industry has grown exponentially in Kenya over the past few years, thanks to people’s acceptance of the technology and the many ways it solves real-life problems.

The mobile money industry has changed how consumers and businesses transact. It has made it easy for Kenyans to transfer funds to each other and pay for goods and services. This has had a positive impact on the quality of life in the country.

Mobile money has made it easy for the unbanked to access financial services such as deposits, savings, credit, and money transfers. The industry has also created new forms of employment for M-Pesa agents.

Mobile money technology has created convenience. More Kenyans can now participate in the economy. M-Pesa has also integrated with banks, giving people easier and faster access to their savings. This has boosted mobile banking usage in Kenya, with some estimates suggesting that half of the population uses mobile banking at least once a month.

To show mobile banking’s impact on the economy, with mobile banking transactions surged a whopping 63% only in 2021, according to reports on Business Insider.

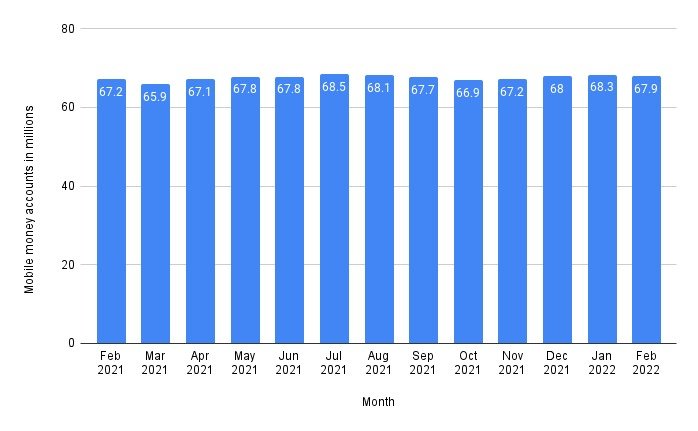

The chart above shows statistics of Kenya's total registered mobile money users from February 2021 to February 2022. The Kenyan mobile money industry has maintained a positive growth flow.

Kenya still grapples with payment interoperability.

Payment interoperability allows banks and other payment service providers (PSPs) from various systems or countries to conduct, clear, and settle payments across systems. It removes the need to use multiple systems to process payments.

As much as Kenya has recorded tremendous growth in mobile money, there is a big gap in payment interoperability. A few years ago, M-Pesa made its API available, and developers started building products that allowed merchants and consumers to accept and make mobile payments.

Although this option exists, a gap still remains in the market. Merchants still need to interface with other payment methods, provide many ways for consumers to pay, send money locally and across borders, build secure digital products, and much more.

At IntaSend, we saw this need and have been working on a payment gateway that solves the issues around payment interoperability. We aim to allow African businesses to integrate once and do more with a single payment gateway.

Interoperability use case: Read - How to receive payment from CashApp in Kenya

How to solve payment interoperability and other payment challenges in Kenya

Improve payment user experience.

Despite M-Pesa's remarkable progress in making life easy and payments convenient in the country, we still need to innovate and improve the user experience.

M-Pesa created STK Push/MPesa Express to enhance mobile payments at POS. That tool makes it easy and fast for customers to pay. With the API, the merchant can pre-fill the payment details. The customer only has to enter their PIN to complete the transaction.

Although this makes payment easy, businesses must integrate, requiring technical skills. Merchants lacking the technical skills must pay a developer to complete the integration.

M-Pesa integration also takes time because of the lengthy process of approval by the provider (M-Pesa). Solutions like M-Pesa Express are great but still hard for the merchants to add to their workflows.

Payment integration should be easy, which entails availing of no-code options. At IntaSend, we have been working on solutions that enable merchants to easily add to their payment processes using as little code as possible.

In addition to the M-Pesa express, we have simplified Buy with Bitcoin, ACH, and card payments (3DS2). Our approach is to create friendly tools for both businesses and developers. Businesses can integrate and transact more successfully.

Create friendlier KYC processes for African users.

Kenyans and many Africans are locked out of international payment services such as PayPal and Stripe because they cannot complete KYC (Know Your Customer) processes. To be AML compliant, payments companies must collect documents identifying the user and verifying their address and bank information.

Enforcing KYC protocols can be challenging in a country where physical address systems are poorly documented and most people are unbanked. For example, in Kenya, more people rely on mobile money services than banks for their banking.

Therefore, Kenya needed a payment gateway that provides services despite these KYC challenges and is still compliant with Anti-Money Laundering (AML). IntaSend has found ways to work with unregistered businesses and freelancers, ensuring they can access international payments while meeting our AML obligations.

Why IntaSend is the best payment processor in Kenya

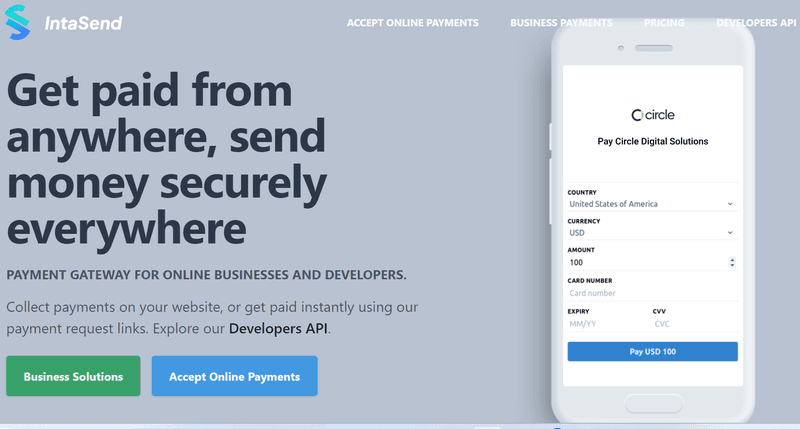

IntaSend is a digital wallet for money transfer, similar to M-Pesa, but with many ways to fund accounts and send money. Ways of funding or accepting payments with IntaSend include M-Pesa, bank payments, Mastercard and Visa card payments, and Bitcoin.

Registered and unregistered businesses can accept payments through no-code payment links, smart invoicing systems, and the payment gateway API. To ensure payment convenience, we provide no-code tools, including WooCommerce/WordPress SDK, Bubble plugin, Shopify M-Pesa and Card app, and RESTFul API and SDKs for developers.

We understand what it takes to build a world-class payment system. Before starting IntaSend, our founders and team worked in the banking sector, where we built scalable payment systems that have improved lives for businesses and the banking public.

Accept online payments easily and securely.

Some years ago, accepting online payments as a merchant was difficult. The process of finding a reliable online payment provider was long and frustrating. However, the narrative has changed with players like IntaSend coming on the scene.

With IntaSend, you can accept online payments from your customers, clients, and donors with just a few clicks. IntaSend is an easy-to-use software with features that allow you to accept online payments securely and with ease.

How does IntaSend make it easy to accept online payments?

Request and receive international payments with just a few steps

With IntaSend, you can seamlessly receive payments from your international clients by creating invoices and sending the payment links without leaving the app or touching any code.

Our platform helps you improve cash flow and reduce costs by automating your back-end processes, so you can focus on what matters most: delivering great service for your clients.

IntaSend is the only solution that allows you to receive payments from your international clients in your local currency, so you never have to worry about exchange rates.

Build custom integrations tailor-made for your business needs

We have made it easy for developers to access tools and SDKs for integrating the IntaSend payment gateway on their websites and mobile applications. We have both code and no-code solutions.

IntaSend’s no-code solutions for mobile apps are designed for developers with minimal experience in mobile app development. The IntaSend SDK provides a complete solution for developers to build a no-code IntaSend payment gateway in their mobile applications. You do not have to write any code.

Our no-code solutions include PHP SDK, Javascript SDK, Python SDK, WooCommerce and Shopify plugins, REST API calls for any language, and Bubble.io.

Enjoy fast payouts

IntaSend understands how important fast cash flow is to the success of any business. That is why we have allowed users to withdraw their funds as soon as they need to.

Bitcoin and mobile money payments are available instantly, while card payments take about 2-3 days to be settled. Once your funds are cleared and are available in your IntaSend account, you can withdraw them immediately. IntaSend supports several Kenyan bank accounts and mobile money wallets like M-Pesa.

You have many ways to get paid.

People love IntaSend’s payment technology's robustness, which has been aided by its partnership with global payment networks like MasterCard and Visa, which have given users more ways to pay.

IntaSend also supports payments to and from several banks and mobile money wallets in Kenya. Our merchants can also accept Bitcoin payments from their customers.

Our ACH service also enables you to get paid by clients based in the USA, even if you don’t have a U.S. bank account. This increases your chances of getting paid by your USA-based clients that don’t have access to the other payment methods we support.

Complete more online payments.

IntaSend boasts a 99.99% success rate with card, Bitcoin, mobile money, and ACH payments. Figures like that make IntaSend the best payment gateway in Kenya.

If your desired payment method fails, IntaSend has a feature that suggests other payment methods the affected clients can try so the money can get to them as soon as possible.

Your support issues addressed, no matter the time of day

If you run into any trouble with your IntaSend account, you can always count on our 24/7 customer support to come through for you. The customer support team can answer your queries through email, live chat, and phone calls.

The best payment service for freelancers and unregistered businesses

As the team behind IntaSend, we have previously worked as freelancers and clearly understand the pain points of receiving payments while in Africa.

Services like Upwork charge up to 20% on transaction fees and take up to 10 days to process payments. Paypal also takes 10 days.

Because of complex onboarding processes, it has also been a big challenge for unregistered businesses (personal accounts) to work with the local payment gateway providers.

I worked for a bank as a consultant software developer and know what it takes to build financial products. I also know the challenges unregistered businesses face when accessing services from traditional banks.

At IntaSend, we see a big opportunity in Africa where KYC processes have locked people out of the banking systems, limited their access to funding, and reduced their economic potential.

We have innovated ways of helping freelancers and unregistered businesses get paid without falling foul of local regulatory bodies. We aim to replicate the same strategy in other African countries in the next 2-3 years.

Why businesses in Kenya trust IntaSend to process their payments

IntaSend is trusted for fast and secure business payments. The IntaSend Business Payments platform is built on a state-of-the-art wallet service that uses traditional payment methods, such as bank transfers with blockchain technology, to provide more efficient, secure, and reliable payment services.

Our robust technology enables businesses to make real-time payments to suppliers and employees in Kenya and anywhere in the world. It is built for security, efficiency, and cost-effectiveness.

IntaSend’s business uses cases.

Here are some of the ways you can use IntaSend in your business:

B2B payments

IntaSend’s business solutions let you send B2B payments from a single dashboard and API. It also allows you to accept customer card payments on your website and send B2B payments from your dashboard.

The IntaSend payment gateway is secure and PCI compliant, ensuring that your payment information won’t be stolen or compromised. We take security seriously and have partnered with SISA Infotech (A global Cyber Security Company) to help secure the gateway. This gateway is tested and under 24/7 surveillance.

We have made the interface intuitive so users won’t struggle with complex settings.

Bulk payments

Our bulk payments feature allows you to send payments to multiple recipients simultaneously. This simplifies payroll, loan disbursements, and other instances when you have many recurring payments to make. The process is as easy as uploading an Excel sheet with the beneficiaries’ details.

You can use your IntaSend dashboard to monitor the status of your payments and check for any errors. This saves you time since you don’t need to manually follow up on each payment.

If you own a business that frequently sends payments to multiple recipients at once, IntaSend is the perfect choice. Our system allows you to send payments to up to 5000 users simultaneously.

Payments API

From setting up your payment method to receiving and sending payment, IntaSend will help you quickly get your payments workflow up and running. The platform has other features to help your business grow, like customisable email templates and real-time payment tracking.

The IntaSend Payments API helps reduce human errors that come with manual payments. It also helps efficiently sends payments to your team, contractors, suppliers, and vendors. It is an easy-to-use tool that allows you to manage and track payments without stress.

How does the Payments API work?

Add beneficiaries

Add a list of all your beneficiaries through the API or dashboard to get started. If you need to make any changes to the list, you can do that through the source file (usually an Excel spreadsheet) and reupload it through your dashboard.

Preview

You don’t want any mistakes when sending payments, so double-check the beneficiary list before authorising payments. This has to be done manually, but the good thing is that once you’ve confirmed the list, you don’t have to repeat this process.

Authorise payments

Once you’ve ensured you have entered the accurate details, you can authorise IntaSend to send payments instantly and securely to your beneficiaries. The software will generate a report for your bookkeeping and records.

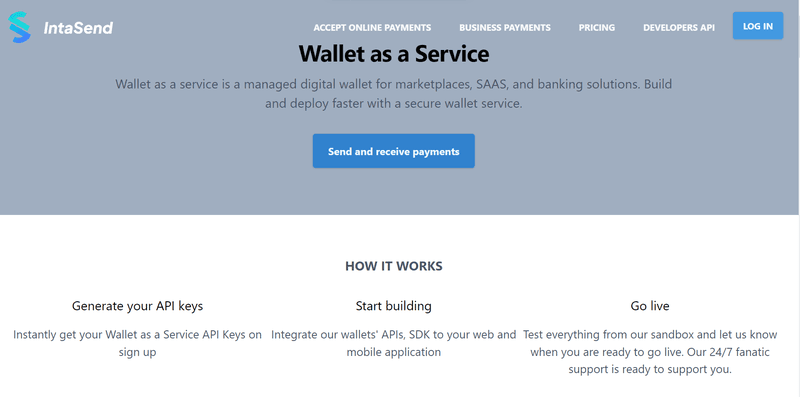

Wallet as a service infrastructure (WaaS)

IntaSend offers a wallets-as-a-service API that businesses can use to create wallets for their customers. We have a sandbox for developers, which includes a platform for building, testing, and managing digital currency-based applications on the IntaSend network.

Developers get access to a payment console for building and testing payments. The API includes wallet as a service and Payment APIs for building digital wallets.

We have put together a couple of use cases for the WaaS product. Learn more in this article.

FAQs - The best payment gateway in Kenya

How do I start using IntaSend?

Getting started on IntaSend is easy. All you have to do is sign up with your email address, phone number, and preferred password, fill in a few details about your business, and confirm your registration from a confirmation email the system will send you.

How much does IntaSend cost?

It costs nothing to sign up with IntaSend. Registration is completely free. However, you will be charged for every transaction you perform via IntaSend, whether card payments, mobile money transactions, or ACH.

Which documents do I need to sign up for IntaSend?

Identity verification is a high priority on IntaSend. After completing an individual verification step, depending on your account type, the required documents range from business registration to KRA Tax Certificates. Learn more about account verification and required documents here.

How long does it take for the IntaSend account to be approved?

After creating an account, you need to submit your verification documents. Our compliance team will review and invite you for a live screening meeting. This process normally takes 1 business day.

What is the live screening meeting?

A live screening meeting is a call with your IntaSend account manager. We do this to understand your business, the people behind it properly, and how you intend to use your IntaSend account so we can set you up with the right tools.

Which countries does IntaSend support?

IntaSend currently supports businesses and users in Kenya. We have plans to support more countries soon.

Get paid from anywhere, and send money securely everywhere with IntaSend

In this article, we have highlighted IntaSend and showed why it is considered one of the best payment gateways in Kenya for freelancers and businesses accepting local and international payments.

IntaSend’s mission is to provide an easy and secure way for Kenyans to transact and bank, and the results for far are encouraging. We have already processed transactions for thousands of users who have grown to trust the brand’s quality of service.

A 2D secure payment gateway, IntaSend stands out from other payment gateways in Kenya because the brand values its users and does its best to give them quality service through safety, convenience, and ease of use. As a brand, we are committed to building a better future for all our customers.

Sign up with IntaSend and enjoy faster and more secure payments, whether you are paying or getting paid and the client or supplier is local or international.

Photo by rupixen.com on Unsplash