How to Get Paid Through Cash App In Kenya [Little-Known Hack]

May 24, 2022

You cannot use Cash App in Kenya or anywhere outside the USA and the UK unless you use our secret hack. Learn how to receive money from Cash App without official access.

Cash App does not work in Kenya or anywhere in Africa. The P2P payment app only works in the USA and the UK. So why are we writing an article on how to receive money through Cash App in Kenya?

Well, there is a way to receive money through Cash App that does involve using the app itself. The money isn’t actually sent as cash, which is why this is even possible.

Learn the nifty trick you can get paid through Cash App and collect the payment in cash in Kenya, and the tool that makes it all possible.

Let’s get started.

What Is Cash App And Why Is It So Popular?

Cash App is a mobile app that allows users to easily send money between one another. Users of the app can send money to each other through phone numbers, email addresses, and innovative $cashtags.

Only available in the USA and the UK, Cash App also has other innovative features that enable things like Bitcoin trading, stock trading, and DIY tax filing. A payment feature has also been introduced for teenagers.

How Freelancers in Africa Can Use Cash App to Get Paid

In 2018, Cash App added support for Bitcoin trading. It's now possible to send Bitcoin from one user to another.

Crucially, Cash App users can also send Bitcoin to crypto wallets that are not under Cash App. This is how Cash App users can send money to people that don’t use or have access to Cash App.

Bitcoin payment on Cash App is instantaneous as transactions do not have to be confirmed on the blockchain. This allows for very fast transactions and payment of goods and services.

And the best part?

Freelancers in Africa can use this feature to receive money from anyone that has a Cash App account. All that a freelancer needs is a platform through which they can receive that Bitcoin. That platform is IntaSend.

The IntaSend payment gateway has a Pay with Bitcoin option that allows merchants, freelancers, and online content providers to receive payment in Bitcoin.

And since Cash App allows Bitcoin payments to non-users of the app, you can now receive payment in Bitcoin from your clients that have a Cash App account. Those payments happen very fast if you are using IntaSend.

There’s more:

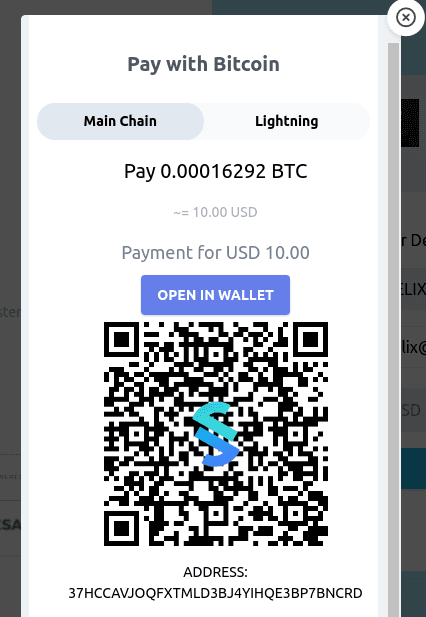

IntaSend supports both the regular Bitcoin payment and Lightning network. The Lightning network is a new form of Bitcoin payment that allows payments to be processed faster through a decentralized network. It’s also cheaper to make payments through the Bitcoin Lightning Network.

Once the Bitcoin hits your IntaSend account, you can immediately convert it to regular currency. This protects you from the volatility of the cryptocurrency market. You can, in effect, receive and withdraw the payment before the cryptocurrency’s value has changed, which protects value.

Advantages of Receiving Bitcoin from Cash App Users Through IntaSend

There are many advantages to using IntaSend for making and receiving business payments. Others that apply specifically to the Bitcoin payments feature include the following:

Fast and secure transfers

Cash App Bitcoin payments are very fast. You don’t have to wait days or weeks to receive your payments. Bitcoin transactions from Cash App through IntaSend are very fast. You can send an invoice to a client and receive the money from the client within minutes.

Cash App Bitcoin transfers do not need blockchain confirmation

A significant reason why Bitcoin and other cryptocurrency transactions take some time to process is that transactions have to be confirmed on the blockchain before they go through.

But Bitcoin transactions using Cash App bypass all these. Transactions go through immediately without needing to get confirmed on the blockchain first. This again helps to preserve value as you can convert and withdraw your Bitcoin payments before they lose value.

Liquidity cover

One major reason why lots of people are afraid of accepting Bitcoin as a form of payment for goods and services is the constant fluctuation of the Bitcoin price.

But you don’t have to worry about that. IntaSend provides a cover for Bitcoin fluctuation. They automatically convert all cash withdrawals from Bitcoin to fiat currency using an appropriate exchange rate.

All transactions are monitored by an expert team, and the money is made available for withdrawal after review by our team of experts.

Support for both Bitcoin Lightning and Mainchain networks

The IntaSend Bitcoin payment gateway supports the Bitcoin lightning network. Bitcoin lightning network transactions are faster than regular Bitcoin mainchain transactions.

This allows you to receive payment instantaneously. IntaSend also allows your clients to choose between both the Bitcoin Lightning and the Mainchain network, if they prefer to be paid in Bitcoin.

Seamless implementation for merchants

If you are a merchant keen to embed Bitcoin payments on your eCommerce website, integration is easy and fast with IntaSend. You can use the web API to do this, so customers see the pay with Bitcoin option when they make purchases on your website.

If you have the API installed previously, you might need to update the WebSDK to see the new Pay with Bitcoin option. Activate it under your account settings on the IntaSend website. Once activated, you can send customers QR codes or a Bitcoin wallet address to get paid using Cash App.

Fast withdrawal of funds

Once your Bitcoin payment is confirmed in your IntaSend account, you can withdraw it immediately if you prefer. The crypto payment is easily converted to fiat currency. You can withdraw it to a bank account or your M-Pesa mobile money wallet and use it as you please.

Minimal transaction fees

IntaSend’s transaction fees are minimal and very reasonable. For example, IntaSend charges less in fees for international payment receipts than both PayPal and Payoneer.

No downtime

The IntaSend payment gateway works 24/7 with no downtime. So, you can get paid on weekends, weekdays, day, or night with no noticeable delays.

Secured transactions

IntaSend uses various security protocols to secure transactions processed using their payment gateway.

No hidden fees

Hidden fees are the most common blight of consumer banking. With IntaSend, what you see is what you get. Every fee is made known to you before you use any of the fintech firm’s services. You will not get any unexpected debit alerts when you receive money using IntaSend.

How to Use IntaSend to Receive Payments Through Cash App

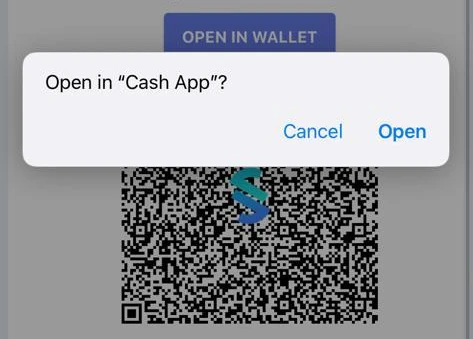

To receive Bitcoin from your clients that use Cash App, IntaSend allows you to send a QR code to those clients. The QR code contains the wallet address that they’ll send the money to, along with the exact price of the Bitcoin that they’ll send.

If you are not sure how much they are going to pay at that time, you can also send the wallet address directly to the customer, who will then send the correct amount of Bitcoin.

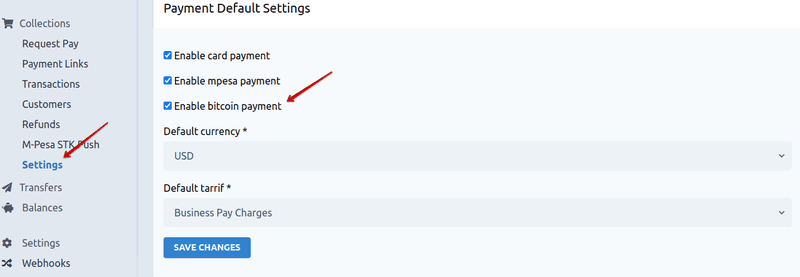

To start using the Bitcoin payments feature, you have to enable Pay with Bitcoin on your account:

Go to your IntaSend account, then click on “collections,” then “settings.” You will see an option for enabling payment with Bitcoin. Tick on that option and save the changes. And that’s it!

If you are using IntaSend’s API on your website, you might need to update the WebSDK, which is the software development kit that will activate more payment options, including the Bitcoin payment option. Upgrade the WebSDK to version 3.0.4 if you haven’t done so.

Once you have the new WebSDK update and the new plugin installed, your customers will be able to see and choose Bitcoin as a payment method on your checkout pages.

We have published a helpful guide on how to do this. Review it if you are unsure how to enable Bitcoin payments on your e-commerce website.

Innovative Features of Cash App that Make it So Appealing to Both Users And Non-Users

What has made Cash App so popular despite restricted availability is its innovative features. Those features mean the P2P payment app has been widely adopted for payments in the USA and the UK.

Many of the app's users would prefer to use the same platforms when paying international contractors, hence the interest in the app by people in countries like Kenya.

Here are the features of Cash App that have made it a preferred payment platform for so many people, including freelancers in Africa who need a way to accept payments from foreigners from the USA and the UK:

Fast and easy way of sending money through mobile phones

Cash App revolutionized mobile money transfer in the US and UK with their simple, efficient mobile money solution. All you need to send money to another person is their $Cashtag, phone number, or email address.

Once you send the money, it arrives very fast. Unverified users can send up to $250 per week, while verified users can send $7500 per week. Unverified users can only receive $1000 per month, while verified users can receive an unlimited amount of funds per month.

Businesses and organizations can use the app

Less than two years after Cash App started, a feature was introduced that allows businesses and organizations to receive money through the app with a simple $Cashtag. So, all kinds of businesses, religious bodies, and NGOs can receive money through CashApp.

Bitcoin support

Cash App supports instant payment using Bitcoin. Payment using Bitcoin on Cash App doesn’t require immediate confirmation on the crypto blockchain, so they are instantaneous.

Support for teenagers

Cash App now allows teenagers to use the app, but they can only sign up with parental consent. Furthermore, their usage of the app is limited to some core features for their protection.

Though limited in scope, this feature has allowed teenagers to receive and send money legally and securely.

Tax filing

Users of CashApp can now file and process their taxes using the app. This allows for an all-in-one solution for prudent financial integrity and for boosting the financial literacy of users.

As you receive money and make transactions using Cash App, you can easily keep track of your transactions and file them appropriately. You can also input cash inflow from other sources, which boosts the feature's usefulness.

Neo-banking

Cash App allows users to transfer money directly to other bank accounts. The money transfers are very fast, thanks to Cash App’s support for automated clearing house direct deposits.

Cash App users can also order what they call the Cash Card, which is a debit card that works just like a regular bank debit card. Users can use the swipe card to shop, withdraw cash and make POS transactions directly from their Cash App account.

Moreover, the debit card is customizable and can be made as trendy or as fashionable as the user wants. After the card is designed on the website, you will receive the debit card via your email address. The debit card is free.

Stock trading function

Cash App now allows users in the US to trade stocks on the app. They can buy whole or fractional shares and sell them when they want. Stock trading on the app follows regular stock exchange trading hours, and stock prices are updated in real-time.

Cash App makes it very easy for first-time investors to use the app and get a lot of returns on their investments.

Reasonable transaction fees

Cash App’s transaction fees are very reasonable. They charge a small percentage as fees for each transaction you make. Their low transaction fees are part of what attracts users and businesses to the app.

The app is free to download. You only get charged transaction fees when you start to use it. If you set up direct deposit, you get free ATM withdrawals.

Secured transactions

Cash App uses various security mechanisms to secure user funds, data, and transactions. All transactions are encrypted whether they are performed via public WiFi, home WiFi, or mobile data.

Cash App also uses advanced fraud detection algorithms to detect fraud. Transactions are cancelled immediately after any fraud is detected. The transaction is then investigated and escalated to the appropriate authorities.

Users can also use OTP (one-time passwords) to log in to their accounts for extra security apart from regular passwords and PINs.

Add Another Way To Secure New Work And Get Paid With IntaSend

If you are a freelancer, using IntaSend for receiving payments from international (as well as local) clients is a no-brainer. We don’t know of many solutions for receiving payments through Cash App if you are outside the US and the UK, let alone getting paid in Bitcoin.

Thanks to IntaSend's Bitcoin payments support, you can now accept work offers from clients that prefer to pay through Cash App. Once they pay. you can convert that Bitcoin quickly and withdraw the payment just as fast through whatever method you prefer.

Proving that it is truly built for the gig economy, IntaSend adds another way to get work and to get paid. IntaSend also makes it easy to get paid, through its invoice and no-code payment link generator, which also reduces the risk of delayed payments as clients can simply click a link and immediately send payment.

Intasend also allows you to receive money from other sources apart from Cash App, including M-Pesa and credit cards. So, you can receive money from anyone within and outside Africa regardless of the payment option they want to use.

Sign up for IntaSend and enjoy fast, secure, and seamless business payments, whether you are the one paying or you are getting paid.