Pay-on-delivery online shopping transfers all financial risks from shoppers to merchants, but are the extra customers it brings worth the risks? Find out what these risks are for e-commerce merchants in Kenya.

In e-commerce, we like to ask customers on our checkout pages, 'How would you like to pay?' That's usually to show them we have provided a few payment methods so they can choose the most convenient.

What if shoppers flipped the question and asked, 'How would you like to get paid?'. 'In advance, or cash on delivery?'

That's an easy one to answer. 'In advance and online, of course' will likely be the quip back at the shopper.

Paying in advance carries less risk and does not invite logistical challenges with returned products.

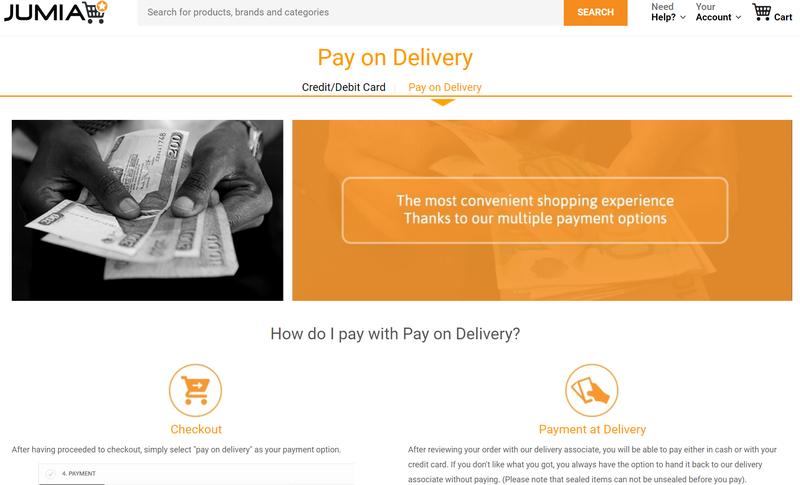

Why, then, are online marketplaces and merchants offering pay-on-delivery services? Jumia, Jiji, and other leading e-commerce merchants in Kenya are now all actively promoting pay-on-delivery services.

Are you missing a trick by not offering cash-on-delivery as a payment option?

This article investigates the phenomenon of pay-on-delivery online shopping in Kenya. After reading this article, you should know if the benefits of cash-on-delivery services outweigh the risks.

Let's dive right in.

What is pay-on-delivery online shopping?

Pay on delivery online shopping is when customers buy goods online but only pay for them after they've received, inspected, and decided to keep them.

Before paying, the customer may want to inspect the shipped items for damage and ensure everything that should have been shipped has been delivered. In the case of clothes and shoes, they may also want to try the items for fit before paying.

Also known as cash on delivery (COD) or cash on demand, pay-on-delivery is the opposite of pay-in-advance, where the shopper pays the total amount when they confirm the order at checkout.

With pay-in-advance, the e-commerce merchant only ships the goods once the customer has paid for them in full. This protects you, the merchant, against frequent returns by buyers who decide on a whim that they no longer want the goods they ordered.

Why cash on delivery is the most popular payment method in Kenya

Cash is more than just the most familiar payment option in Kenya. It is, for some shoppers, the only accessible payment option. Credit and debit cards are not accessible to everyone, and many people are uncomfortable paying for goods in advance or sharing their credit card information online.

People shopping online for the first time feel safer paying after they have received their goods. Some would have heard stories where people have not received the goods they purchased online.

Of course, there are more honest e-commerce retailers than unscrupulous ones. But bad news travel fast. Those few bad apples spoil the good work of honest merchants working hard to improve perceptions about e-commerce.

Some merchants also make it hard for customers to return goods bought online, even where there is a valid reason for the return. So e-commerce merchants reluctantly offer pay-on-delivery payment options so customers can try products risk-free.

Try-before-you-buy may be the only way to sell clothes online.

Some products, like women's clothes, are hard to 'fit' online, no matter how detailed your product descriptions are.

The human body has so many unique shapes that it is hard to size clothing, especially when there are so many designs. How many 'what I bought vs what I got' memes have you seen on social media?

So if you sell women's clothing and insist on pay-in-advance payments and have no clear return and refund policies, you will struggle to sell. You may have no option but to deliver and let customers try the clothes before paying for them.

Amazon has a try-before-you-buy service for clothing and footwear where customers have seven days to try items before deciding what they will keep. However, it's telling that this trial period service is only available to Prime customers with a chargeable card on file.

Try-before-you-buy presents many risks in markets where shoppers are less trustable. What stops the buyer from wearing the clothes a few times before returning them? On not returning them at all?

Trial periods should only be offered to a select, verified group of customers. If you provide it to everyone, too many returns could be the least of your worries. You could be dealing with theft by people who decide to extend the trial period indefinitely.

So pay-on-delivery online shopping dos reduce financial risk for shoppers. It can also boost your sales by convincing skeptical shoppers to place orders.

How does cash-on-delivery work for the seller

The average e-commerce merchant in Kenya views pay-on-delivery as something they must put up with to get sales. If your competitors offer it and you don't, they will look more trustworthy and steal your customers.

To use a pay-on-delivery sales strategy, you must have it as a payment method on your checkout pages. For example, you can have Visa, Mastercard, M-Pesa, Bitcoin, and Pay-On-Delivery as payment methods.

Customers will fill their carts and checkout the standard way. But instead of choosing M-Pesa, Visa, or Mastercard as payment methods, they choose Pay-On-Delivery. They will then enter their address, phone number, and other details.

The merchant then processes the order and passes it to the shipping agent or delivery company. The delivery crew will hand the order to the customer to check if it's what they ordered. If they are satisfied, they will pay and keep the item.

To reduce the risk of returns due to non-payment, you want to ensure the delivery crews can accept multiple payment methods. As well as a swipe card reader, they should also accept mobile money, cheques, and cash.

Cash-on-delivery benefits for the seller

Even though pay-on-delivery primarily benefits the customer, it has some benefits for the merchant. Let's consider those:

1. Boosts average order value

Pay-on-delivery improves your chances of selling more since you send more items for the customer to try. Some customers struggle to decide what to return and take more than they had intended to buy.

2. Expands your customer base

You also expand your market by including customers who may otherwise be unable to pay through your other payment methods. Pay-on-delivery also boosts your conversion rates since it gives customers more ways to pay, including cash, check, debit card, and mobile money.

3. Boosts customer satisfaction.

If you manage it well, pay-on-delivery can create customers for life out of those that feel catered for. It portrays you as willing to go the extra mile to meet your customers' needs.

4. Increases your credibility

Customers who insist on paying on delivery argue that merchants need not worry about returns if they are confident with the quality of the products they sell and have nothing to hide. Using this argument, those merchants that accept cash-on-delivery terms enjoy more credibility in the eyes of online shoppers.

Risks of pay-on-delivery online shopping for sellers

Is the risk of pay-on-delivery worth the new customers it can attract to your e-commerce store?

Here are a few risks you should know about before you follow a pay-on-delivery sales promotion strategy:

1. Raises the risk of stockouts.

Pay-on-delivery encourages shoppers to order more items than they can pay for. Unfortunately, this depletes your stocks, leaving insufficient inventory to process incoming orders. What's worse is that you can't order more stock because you risk overstocking when the returns make it back into stock.

2. It makes it easy for customers to cancel orders.

Pay-on-delivery empowers customers to reject orders because there is no risk to them. It gives shoppers time to reconsider their purchases, which encourages returns.

That said, returns are not always caused by a customer's unwillingness to pay. They can also be due to their inability to pay. When the delivery arrives, the customer may no longer have enough or any money to pay for their order.

3. Security challenges of carrying cash

Cash-on-delivery payment options expose delivery crews to robberies by thieves attracted by the money delivery crews collect from customers.

You also have to consider the risk of theft of returned items by the shipping company's drivers. Manual errors can also happen when an item is handled and processed too many times.

4. Increases the cost of selling

Collecting payments from customers on your behalf is an added service that your shipping partner will inevitably bill for. As a result, it will eat into your revenue and make your business less profitable unless you can pass this cost to the customer.

How to minimize risks associated with pay-on-delivery at your e-commerce business

Returns from customers who choose not to accept their orders on delivery can wreak havoc on your e-commerce business. So you may need to put safeguards in place so customers don't abuse the service.

1. Ask for a deposit

A fair demand is that you ask the customer to meet you halfway and pay a part of the purchase price in advance. This way, the customer has something to lose, which can force them to think twice before rejecting an order.

2. Make customers pay for shipping upfront.

Not all customers will accept putting something down for their order before it's delivered. So even though it may limit your store's sales potential, you could charge a delivery fee to offset the cost and the high risk of returns.

An alternative to that is to ask customers to pay the shipping cost if they decide to return their ordered items. But, again, that will turn some shoppers off, so you will have to weigh the risk against the benefit.

3. Offer incentives for online payments.

Of course, the best way to deal with the risks associated with pay-on-delivery is to remove them by enticing customers to pay in advance. As an incentive, you can offer discounts when people pay in advance.

Of course, you want to ensure customers can easily pay in advance by providing enough payment options. With the standard Visa and Mastercard card payments, you want also to add M-Pesa as a payment option.

If you have a Shopify store, using the IntaSend payment gateway even adds Bitcoin as a payment method. So the more payment methods you have on your checkout page, the easier it will be for people to pay in advance.

Close more sales online and get paid in advance with IntaSend.

Pay-on-delivery may have become the most preferred payment method for online shoppers. But the goal for e-commerce merchants should be to get more customers to pay in advance, which is hard to do if you are not using the right payment gateway.

With IntaSend, you have a payments partner that simplifies checkout and reassures shoppers that paying online and in advance is safe. Our payment gateways for Shopify and WooCommerce are designed to streamline your checkout processes and put your customers at ease.

IntaSend helps you collect payments on your e-commerce website, whichever way your customers prefer to pay. Our payment gateway is PCI DSS compliant, guaranteeing the security of your customers' funds and personal information.

Sign up for IntaSend to access our payment gateway plugins and start collecting customer payments right on your e-commerce website.