Why Kenyans Abandon Your Checkout on Valentine's Day

Feb 10, 2026

How to fix it

Updated: February 3, 2026

The Most Expensive Moment in Your Valentine's Campaign

You did everything right.

Your products are perfect. Your Valentine's bundles are curated. Your social media posts drove traffic. A shopper landed on your store, found the ideal gift, added it to cart, and clicked checkout.

Then they left.

No purchase. No explanation. Just a ghost.

This is cart abandonment. And during Valentine's season, it costs Kenyan e-commerce businesses thousands in lost revenue every single day.

The global cart abandonment rate sits at 70.19% (Baymard Institute, 2024). In Kenya, payment-related abandonment pushes that higher—closer to 75-80%—because most e-commerce stores aren't optimized for how Kenyans actually pay.

The good news? Most of these abandoned sales are recoverable. The problem isn't your product or your price. It's your checkout.

Kenyan shoppers are already searching for Valentine's gift alternatives following the CBK cash bouquet ban. That traffic is coming to your store. Make sure your checkout is ready to convert it.

Why Valentine's Abandonment Is Different

Cart abandonment during Valentine's has unique characteristics that make it both more damaging and more fixable than regular abandonment.

The Urgency Factor

Valentine's shoppers are emotionally invested in completing a purchase. They're not casually browsing—they need a gift by February 14th. When checkout frustration hits, they don't patiently try again later. They leave immediately and buy from a competitor who makes it easier.

Regular shopping abandonment: "I'll come back tomorrow." Valentine's abandonment: "I'll just go to the other site. Deadline is tomorrow."

The Mobile Problem

78% of Kenyan Valentine's shoppers browse and buy on mobile phones. Most e-commerce checkouts are designed for desktop. The result is a painful mobile checkout experience that kills conversions at the worst possible time.

The Payment Method Mismatch

This is the biggest Valentine's killer. A shopper with M-Pesa on their phone lands on your checkout and sees only card payment options. The sale is dead before it started.

Over 90% of Kenyan adults use mobile payments, with M-Pesa dominating the market. Less than 10% regularly use cards for online shopping. If your checkout doesn't reflect this reality, you're losing the majority of potential customers at the final step.

The 6 Checkout Killers (And How to Fix Each One)

1. No M-Pesa Option

The problem:

A shopper sees your Valentine's bundle, loves it, clicks buy, and finds only Visa/Mastercard at checkout. They don't have a card, don't trust entering card details on an unfamiliar site, or simply prefer M-Pesa. They leave.

This single issue accounts for the majority of Kenyan checkout abandonment.

The fix:

Make M-Pesa your primary payment option. Not an afterthought buried below card fields—front and center, first option, most visible.

What the ideal checkout looks like:

M-Pesa (prominently displayed, first option)

Card payments (Visa/Mastercard)

Bank transfer (for larger orders)

Implementation: IntaSend integrates M-Pesa directly into Shopify and WooCommerce checkouts. Setup takes 30 minutes. See the Shopify integration guide or WooCommerce setup guide to get started.

Expected improvement: 30-40% reduction in payment-related abandonment.

2. Too Many Checkout Steps

The problem:

Account creation requirements. Long forms. Multiple pages. Address fields that don't need to exist for digital products. Every extra step is a door your customer can walk out of.

The Valentine's reality: Your shopper is on their phone during lunch break. They have 4 minutes to complete this purchase before their boss notices. Five checkout pages = abandoned cart.

The fix:

Reduce checkout to 3 steps maximum:

Cart review (what they're buying)

Delivery details (name, phone, address)

M-Pesa payment (enter number → STK push → PIN → done)

Specific changes:

Remove mandatory account creation (offer guest checkout)

Eliminate unnecessary form fields

Auto-fill where possible

One-page checkout if your platform supports it

Shopify: Enable accelerated checkout. Remove unnecessary fields in checkout settings.

WooCommerce: Use checkout optimization plugins. Remove billing fields that aren't needed for your products.

3. Slow Loading Pages

The problem:

Kenyan internet connections vary significantly. A checkout page that loads in 2 seconds on fiber takes 12 seconds on mobile data. Every second of loading time increases abandonment by 7%.

The Valentine's context: Your impatient, deadline-driven shopper is not waiting 12 seconds for your checkout to load. They're already on a competitor's site.

The fix:

Compress all product images using TinyPNG

Remove unnecessary plugins and scripts from checkout pages

Use a fast, reliable hosting provider

Enable caching on your store

Test your checkout speed on mobile data, not just WiFi

Test tool: Google PageSpeed Insights (free). Target: under 3 seconds on mobile.

4. No Trust Signals at Checkout

The problem:

Your shopper reaches checkout and suddenly panics. "Is this site safe? Will my M-Pesa go through? Will they actually deliver before February 14th?"

Doubt kills sales. Especially at higher Valentine's bundle prices.

The fix:

Add trust signals directly on the checkout page:

Payment security:

"Secured by IntaSend" badge

SSL certificate indicator (padlock in browser)

"M-Pesa payments protected" messaging

Delivery confidence:

"Order by Feb 12 for guaranteed Feb 14 delivery"

Clear delivery timeline displayed at checkout

Delivery tracking promise

Business credibility:

Customer review count

Physical contact (WhatsApp number, email)

Return/exchange policy link

The goal: Make your shopper feel safer completing the purchase than abandoning it.

5. Unexpected Costs at Checkout

The problem:

Shopper sees bundle at KES 7,500. Clicks checkout. Suddenly it's KES 8,200 after delivery fees, handling charges, and whatever else appeared.

Sticker shock kills more Valentine's sales than almost anything else. Nobody likes surprises at checkout—especially not on a time-sensitive emotional purchase.

In fact, unexpected extra costs are the number one reason shoppers abandon carts globally, cited by 48% of shoppers in Baymard Institute's research.

The fix:

Be transparent from the start:

Show delivery costs on product pages, not just checkout

If offering free delivery, highlight it prominently

"Free delivery on orders over KES 5,000" displayed on homepage and product pages

No mystery charges appearing at the final step

If delivery costs are unavoidable:

Show them early in the checkout flow, not at the payment step

Offer free delivery for Valentine's bundles as a promotion

Consider absorbing delivery costs into bundle pricing

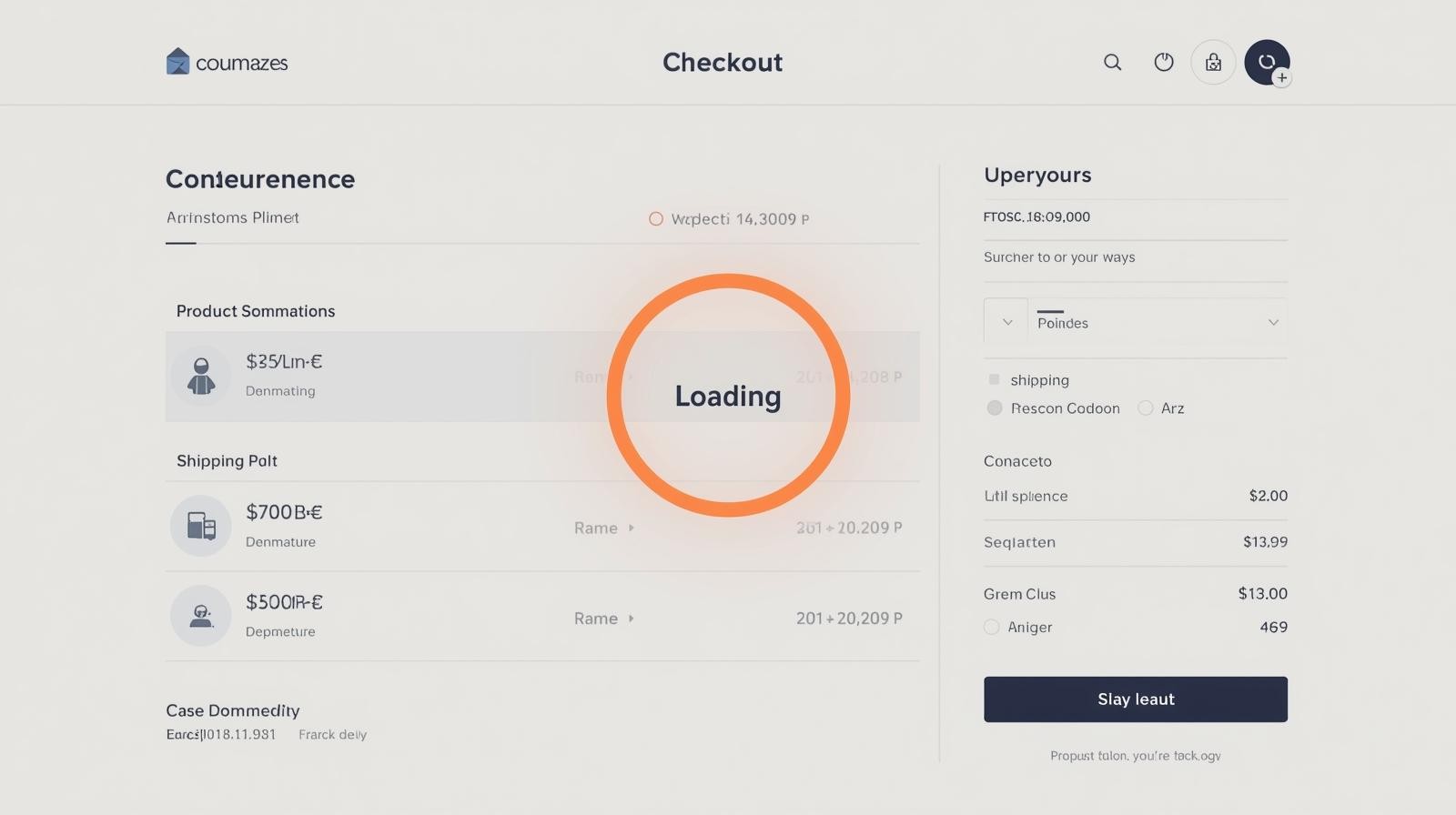

6. Failed Payment Recovery

The problem:

Sometimes payments fail. M-Pesa timeout. Wrong PIN entered. Insufficient balance. Network error. The customer gets frustrated, doesn't know what happened, and leaves without trying again.

Valentine's impact: That customer needed a gift by Feb 14th. They're not coming back to figure out what went wrong. They're going elsewhere.

The fix:

Immediate response to failed payments:

Clear error message explaining what happened

Specific instructions for retry ("Please re-enter your M-Pesa PIN")

Alternative payment option offered immediately

Customer service contact visible ("Need help? WhatsApp us: +254 711 082 947")

Follow-up automation:

Send WhatsApp/SMS within 10 minutes of failed payment

"Hi [Name], it looks like your payment didn't go through. Your Valentine's gift is still waiting. Complete your order here: [link]"

Offer assistance or alternative payment method

With IntaSend, failed payment notifications are instant, giving you a window to recover the sale before your customer moves on.

The M-Pesa Checkout Experience: What It Should Feel Like

Here's the ideal Valentine's M-Pesa checkout flow. Time it: it should take under 60 seconds.

Step 1: Customer clicks "Buy Now" on Valentine's bundle Step 2: Reviews order (items, price, delivery date) Step 3: Enters name, phone number, delivery address Step 4: Selects M-Pesa at payment step Step 5: Enters M-Pesa number (auto-filled if returning customer) Step 6: Receives STK push on phone Step 7: Enters M-Pesa PIN Step 8: Sees "Payment Successful" confirmation Step 9: Receives SMS confirmation + WhatsApp order details

Total time: 45-60 seconds Customer effort: Minimal Abandonment risk: Very low

If your current checkout takes longer than this, you have revenue leaking at every step.

Real Results: What Happens When You Fix Your Checkout

Don't take our word for it. Western Cosmetics, a Kenyan e-commerce business, was losing customers daily to failed M-Pesa payments, slow confirmations, and confusing checkout flows.

After switching to IntaSend's optimized M-Pesa checkout:

62% more conversions

Eliminated manual payment verification

Customers completed purchases in under 60 seconds

Team stopped spending hours matching payment screenshots to orders

The checkout problem wasn't unique to them. It's the same issue costing Kenyan e-commerce businesses sales every day—and it's especially damaging during Valentine's when every abandoned cart is a missed deadline.

See more customer stories from Kenyan businesses that fixed their checkout experience.

Valentine's Checkout Checklist: Fix These Before February 12th

Run through this before Valentine's traffic peaks:

Payment:

M-Pesa enabled and working (test it yourself right now)

M-Pesa displayed as primary payment option

Card payments available as secondary option

Payment confirmation SMS/email sends immediately

Checkout flow:

Guest checkout enabled (no forced account creation)

Checkout completes in 3 steps or fewer

Mobile checkout tested on actual phone

Page loads in under 3 seconds on mobile data

Trust and transparency:

Delivery date prominently displayed

All costs shown before payment step

Security badges visible at checkout

Customer service contact visible

Recovery:

Failed payment error messages are clear

WhatsApp/SMS recovery flow set up

Someone monitoring orders Feb 12-14

Where Kenyan Shoppers Are Buying This Valentine's

Businesses already using optimized M-Pesa checkouts through IntaSend are positioned to capture Valentine's traffic. TheFlorist254 for fresh flower delivery, kayamoko for African fashion gifts, Remy Wigs for beauty and personal care, and NairoMarket for everything from electronics to accessories—all offer seamless M-Pesa checkout that keeps customers moving from browse to buy without friction.

With Kenyans actively searching for alternatives to cash bouquets this Valentine's, the traffic is real. See how businesses like these are achieving up to 62% more conversions after optimizing their checkout with IntaSend.

The Bottom Line

Valentine's Day doesn't reward the business with the best products. It rewards the business with the smoothest path from "I want this" to "I bought this."

Your checkout is that path.

Fix the M-Pesa integration. Reduce checkout steps. Load fast. Be transparent about costs. Recover failed payments. Build trust at the final step.

Do these six things and your Valentine's conversion rate will improve significantly.

The traffic is coming. Make sure your checkout is ready to receive it.

Fix Your Valentine's Checkout Today

Shopify merchants: Install IntaSend Payments App

WooCommerce merchants: Set Up M-Pesa Payments

All merchants: Create IntaSend Account

Need help with setup?

Email: support@intasend.com

WhatsApp: +254 711 082 947

Hours: Monday-Friday, 8 AM - 6 PM EAT

Valentine's traffic peaks in a few days. Fix your checkout today.

All banking services are securely provided by our licensed banking partners who are members of deposit insurance schemes, ensuring the safety of your funds.

Email: support@intasend.com, hello@intasend.com

Phone: +254 711 082 947 | +254 114 114 644