How to Choose a Payment Gateway - Guide for Merchants in Kenya.

Aug 9, 2023

Your choice of payment gateway can make or break your e-commerce business. Let how to choose a payment gateway that simplifies checkout for your customers.

A payment gateway is your online business’s virtual Point Of Sale terminal, whose efficiency, cost, and security are crucial for your business’s success.

A good payment gateway not only saves you money but also smoothens the checkout process for your customers and protects their payment information against theft and interception by hackers.

So, the payment gateway you choose must not be a random choice but a carefully considered one. And today’s article on how to choose a payment gateway discusses the factors to consider when selecting one.

Let’s dive right in.

What is a payment gateway?

A payment gateway lets you accept card payments on your website or app. It authenticates card information entered by customers, communicates it to the payment processor for onward transmission to the card-issuing bank, and communicates the response back to the customer.

A payment gateway is embedded in the checkout process. It serves as the customer’s interface, a web form where they enter their card number, expiry date, and CVV number and informs them if a payment has succeeded or failed.

An easier way to understand what a payment gateway does is to imagine it as a POS machine in a supermarket. The POS machine captures a customer’s card data and reports back to inform the customer that their bank has authorised or declined the payment.

If, for example, the bank account the customer’s card is linked to is overdrawn, the payment gateway - as would a POS machine - will display an ‘insufficient funds’ message.

Why do you need a payment gateway?

You must integrate a payment gateway on your website to accept card and mobile payments. A payment gateway simplifies checkout by aggregating different banks and card networks into one system.

Without a payment gateway, you would have to communicate with individual customers’ banks to ascertain if they have enough funds to cover their purchases.

You would do this for every card payment, which, considering the high number of banks you would need to deal with, would make checking out a long and frustrating experience for your customers and a costly one for you.

A payment gateway is necessary for online transactions, like a POS machine, to process in-person payments in brick ‘n mortar businesses.

How to choose a payment gateway

A payment gateway determines what payment methods you can accept from your customers. In Kenya, you must be able to accept M-Pesa mobile payments.

The M-Pesa mobile money wallet is used by virtually every economically active Kenyan, and not accepting it on your online store would mean many lost sales.

On the other hand, if you are also targeting the international market, you must add payment methods people in those other countries are familiar with. Visa and Mastercard cards are universally accepted and would be obvious choices.

Many people now also have Bitcoin digital wallets, which makes cryptocurrency an alternative payment method for them. Adding more payment methods would boost your chances for more sales.

You can use any of the many payment gateways, some targeting local online merchants and others serving a global market. Different payment gateways also come with different payment methods.

So, when choosing a payment gateway, several factors must be considered. Below we look at some of these factors.

Security

A data breach can destroy your image and invite lawsuits that can bring your business to its knees. Ensure your payment gateway has a strong security system to protect your customers' payment information.

Choose a PCI-compliant payment gateway. This means that the payment gateway meets the security standards of the Payment Card Industry Security Standards Council.

Reliability

If your payment gateway is constantly down, your customers will get annoyed and take their business where they are guaranteed service. Your payment gateway should be reliable and have a good track record of uptime.

Features

Choose a payment gateway that offers the features you need in your business, such as fraud protection, recurring billing, and multiple payment options.

A payment gateway with fraud protection will help protect your business from fraudulent transactions. Multiple payment options let customers choose the payment methods they can and want to use, leading to more successful sales.

Cost

You have a problem if the fees you pay for using your payment gateways eat a significant chunk of your profits. Since payment gateways vary in their fees, you must exercise care and choose one that fits your budget.

Integration

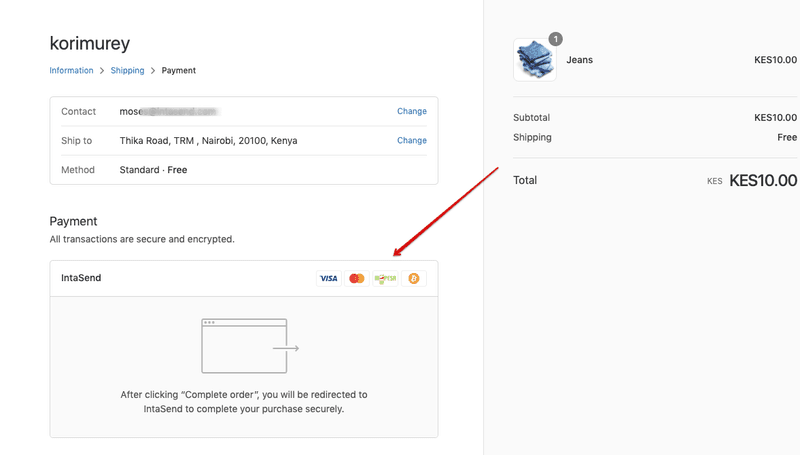

Make sure your payment gateway is easy to integrate with your online store. IntaSend, the best payment gateway in Kenya, has provided an API and guides that simplify integration with your website. Integration does not require writing any code and can be accomplished in a few steps.

Customer support

Choose a payment gateway that offers good customer support. If you have any problems with the payment gateway, you should be able to get help from the payment gateway's customer support team.

Once you've considered these factors, you can start comparing different payment gateways. Here are a few of the most popular payment gateways:

IntaSend,

Pesapal,

Direct Pay Online,

Flutterwave,

Jambo Pay.

Take your time before settling on a payment gateway. Research and read reviews to learn what every payment gateway offers so you can be sure which one is right for your business.

FAQs - How to choose a payment gateway

Which payment gateway is best for international payment?

The best payment gateway offers multiple payment methods that your international customers would be familiar with. For example, the IntaSend payment gateway has Mastercard and Visa cards and Bitcoin options, which are universally accepted.

How do I avoid paying payment gateway charges?

Unless you don’t mind losing customers over a payment gateway that makes it hard to complete purchases, you should use a high-quality payment gateway. Such payment gateways use the latest technology, which costs money to maintain and means you can’t avoid charges.

That said, there are ways you can save on payment gateway fees. These include enforcing a minimum sale amount for card payments, minimising chargebacks, and using a more efficient payment gateway.

Is Visa a payment gateway?

Like Mastercard, Visa is a card network that issues cards through financial banks and provides the technology that powers online transactions. Visa is not a payment gateway; it is a payment processor.

Is Paypal a payment gateway?

PayPal is an online payment system combining payment gateway and payment processing functions. It also offers a digital wallet service, which has become a popular digital payment method.

What is the difference between a payment gateway and a digital payment?

Payment gateway technology allows online merchants to accept digital payments, which are payments that are conducted electronically or over the internet. So, payment gateways enable digital payments.

Choose the right payment gateway for your business and customers’ sake.

A bad choice of payment gateway is bad for everyone - your business and your customers. But your customers can shop elsewhere, which are sales your business can never get back. And that’s if your online store survives.

All the steps you go through setting your business up, like raising capital, registering the business, and stocking up, may seem more important. But all that may come to nought if customers cannot easily pay for their purchases using the payment methods they want to use.

So it’s crucial to take your time when choosing a payment gateway for your business. Choose one that reassures your clients that their payment information is safe and does not cost your business too much money.

Choose the IntaSend payment gateway for faster, more secure, and smooth customer checkout. We have an API that simplifies integration with your Shopify or WordPress website.