How to Choose a Cross-Border Payment Platform and API

Dec 4, 2024

Choosing the right cross-border payment platform for your business may be daunting. However, cost and speed are the two most common factors influencing people’s choices. So, you want a platform that will ensure efficiency and reduce the risks of transactions. With new solutions coming into the market, it is important to find the right one that suits your business needs.

Due to these platforms existing in silos, each country or region often has different rules and protocols. However, the basic concepts are the same.

Although these solutions aren’t new, they’re constantly evolving to meet their customers’ ever-growing need for speed and affordability.

This blog post provides

An overview of cross-border payments, also known as FX payments

The role of APIs in this ecosystem, and

Critical factors that may affect your choices.

What is a Cross-Border Payment?

As the name implies, a cross-border payment is a transaction between two countries. In other words, the payer resides in a different country from the recipient. Payments are processed and received in the recipient's local currency. Recipients may have to worry about currency conversion, but it shouldn't be a big deal since payment innovations are constantly introduced.

These payments can be between companies, banks, and even individuals.

In the past, bank accounts were the most common entry point for international payments. But cross-border payments have become more popular with the quest for faster and cheaper options, with several payment options to help make payment processing easier than ever, especially with traditional cross-border payment. The payment details are not as complex as they used to be, and real-time payments are what make cross-border payments so powerful.

These platforms also lower the risks of fraud or unexpected currency exchange fees.

Are Cross-Border Payments Difficult?

In the past, cross-border payments were complicated and expensive. Banks had to convert currencies daily and charge fees for each transaction. The process also required coordination with multiple banks to ensure that they complete transactions on time.

However, the introduction of APIs has simplified cross-border payments and made them more affordable. The reduced steps for sending and receiving payments have also shortened processing time. Thus, when you make a payment, the recipient can confirm it in real-time.

How Does Cross-Border Payments Work?

You can make cross-border payments by integrating a payment service provider (PSP) or an e-money issuer.

PSPs are companies that provide payment services to other companies. You can use them for both domestic and cross-border payments.

E-money issuers, on the other hand, are companies that issue e-currencies. These digital currencies occur under different names that businesses can use for their operations.

Let’s explore the four most common cross-border payment methods today.

Six Most Common Cross-Border Payment Methods

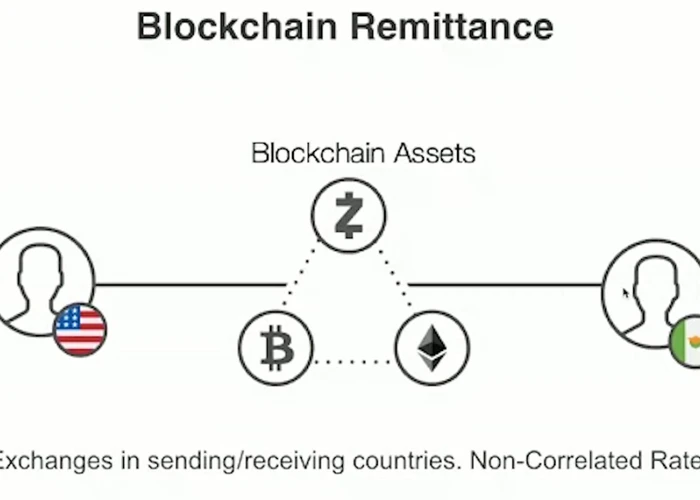

1. Money transfer service/remittance

This service allows companies to send money to other countries through providers such as Moneygram and Western Union. The central bank of the payer’s country regulates the process.

Although these methods are popular, they are mostly pickup payments and are not automated.

2. Wire Transfer

This service allows businesses and individuals in different countries to transfer funds domestically or internationally. However, in most countries, sending a wire through a bank is mandatory. Plus, it involves a service fee.

3. B2B2C Fintech services

Fintech companies such as IntaSend provide API and ways you can automate cross-border payments. Fintech facilitates a secure and faster channel of moving money for both businesses and individuals.

Crypto-currency

Crypto-currency provides a new way for businesses and individuals to receive payments faster and without interference from the regulator. Although they are known to be very volatile, we at IntaSend, through our innovation, we have found a way of protecting the user from loss due to drastic changes in price/value against the dollar. Learn more here on how to receive Bitcoin payments and instantly convert to USD with IntaSend.

The Role of APIs in Cross-Border Payments

An API, or application programming interface, creates a bridge between two processes or systems. These systems communicate with each other through a human-readable interface.

Through payment APIs, merchants can accept payments from their customers. It’s a translator that interprets the money into the recipient’s currency.

Integrating with third-party PSPs allows the API to access relevant information, validate the provided details, and automate payments. This enables mass payments, single disbursements, schedule disbursements, KYC, AML, and fraud checks automation. These are essential components for cross-border payments.

Finding the Right Cross-Border API

First, you must choose your ideal international payment provider to help you send or receive cross-border payments. Then, you need an API to connect your business to your payment platform partner or bank's APIs.

Payment providers charge specific fees to process payments on your behalf. Sometimes, each transaction may cost you 2% plus $0.30. This fee often goes up when you send larger amounts.t.

Some of the features of these APIs include sending and receiving money via email or bank transfer. Hence, businesses can track transactions within their bank account without worrying about entering them into spreadsheets manually.

However, you must be aware of some critical factors when choosing your partner.

1. Value Proposition

At his point, you need to ask yourself a few questions.

How does my preferred choice offer value?

Is it another "me too" service with a few more options?

Or does it have a feature that sets it apart from the rest?

2. Customer Support

When you hit a crossroad,

How well do they respond when you contact them?

Are their customer service representatives knowledgeable enough to answer all your questions?

3. Trustworthiness

You must choose a platform with robust security infrastructure. A platform that can prevent fraud or reduce your risk of getting on the bad side of the law is preferable.

4. Cost

You want to determine if your preferred platform has added charges to the average platform. If they do, is the extra cost justifiable?

Using IntaSend Remittance and cross-border API

IntaSend Payments is a cross-border invoice payment service that enables businesses to send invoices electronically, paperlessly, and securely.

You can attach IntaSend API to any billing system or payroll. This allows you to make payments with ease and fewer human input errors.

The API will then convert the amount from your chosen currency into the currency of your customer's banking institution and send it across.

The cost of using IntaSend's remittance API will depend on the amount sent. Charges range from 3% to 5% of the sending amount.

The platform is affordable for both small and large businesses that plan to send money, pay remote workers, run B2B payments, etc.

How to Integrate IntaSend into Your Business

The first step is to contact the IntaSend team and answer some basic questions about your business.

Then, you may have to provide additional information or documents before they give you an API key. Finally, the API key allows you to integrate with the platform. IntaSend offers the best API solution for cross-border payments, so you will undoubtedly get the best results when processing cross-border transactions with IntaSend's cross-border payment API.

Conclusion

One of the essential steps to enjoying international payments is choosing the right cross-border payment platform and API. While most people might go for affordability, you might want to think of a platform that guarantees efficiency and protection from potential risks.

IntaSend is anti-money laundering (AML) compliant. So, the platform protects businesses from potential legal action from authorities in both countries by keeping them compliant with AML requirements.

Did you find this guide helpful?

Then contact our team anytime for further clarification

Also, share with friends and colleagues that you think may need this solution.