Payment Gateway without Company Registration : How to get started

Aug 29, 2022

IntaSend is a digital payments platform that allows businesses to accept payments without needing to set up their own payment systems. By using IntaSend, businesses can accept payments from customers using a wide range of payment options, including credit cards, direct bank transfers, e-wallets, and digital currencies. No company registration is required for getting a payment gateway account with IntaSend. You just need to meet their minimum operating standards and start your business. Here’s a look at what IntaSend provides and how you can get a payment gateway without company registration.

What is IntaSend?

IntaSend is a leading payment provider in Kenya and the whole of East Africa, thanks to its beneficial products and services. IntaSend has been operating since 2019 and has been helping its clients with their payments for a long time. Today, the company generally provides payment services to many clients in Kenya and Africa, including merchant payments, invoicing systems, and payment API integration.

IntaSend is a reliable choice for its clients because of its strong network, quick and secure payments, and wide range of payment options. The company has grown to become one of the largest payment providers in East Africa, thanks to its ability to adapt to the needs of the changing payments industry.

IntaSend is an innovative financial services company that provides financial services to individuals and businesses in Kenya. The company provides a wide range of financial services for both individuals and businesses, including money transfers, payroll services, and many more.

The company offers a range of payment solutions to allow customers to make and receive payments, including ACH, card payments, and instant payouts. Customers can also send money anywhere in the world using various convenient options, including mobile money. IntaSend’s commitment to the region has helped it build a strong community of customers and business partners.

Why do you need an payment gateway?

In the digital world, cashless payments are the need of the hour. Digital transactions save time, effort, and cost involved in handling cash. Businesses can increase their customer base and reach by accepting online payments. Consumers can save on shopping and spending habits, and the economy benefits. Over the years, we have seen many players come and go, but today, a handful of companies dominate online payments. PayPal, Stripe. Venmo, CashApp, and Payoneer are some of the biggest players on the global level.

The need for cashless payments has birthed the rise of payment gateways. These companies allow consumers to pay for goods and services using smartphones instead of traditional plastic or cash. Over the last year, some of the largest companies in the world have started to invest in these companies, hoping to become the go-to platform for digital payments.

Payment gateways allow you to make payments without carrying cash or cards. They let you pay online, in-app, and at physical locations with a single tap or scan. They are one of the many ways technology is changing how we pay, becoming increasingly common in today’s society. Payment gateways have become more prevalent over time, and they will continue to grow in importance as they become a more convenient way to pay. This has been demonstrated by the increase in their use across today’s society.

As of 2018, 83% of all card payments in Kenya were made using a payment gateway, and this proportion is expected to grow by a chunk by 2025. The rise of these gateways has led to new ways for consumers to pay, including digital wallets and mobile payments. These have become important ways for consumers to pay, with around one-third of Kenyans saying they have used a digital wallet over the past year. Mobile payments have also become more popular.

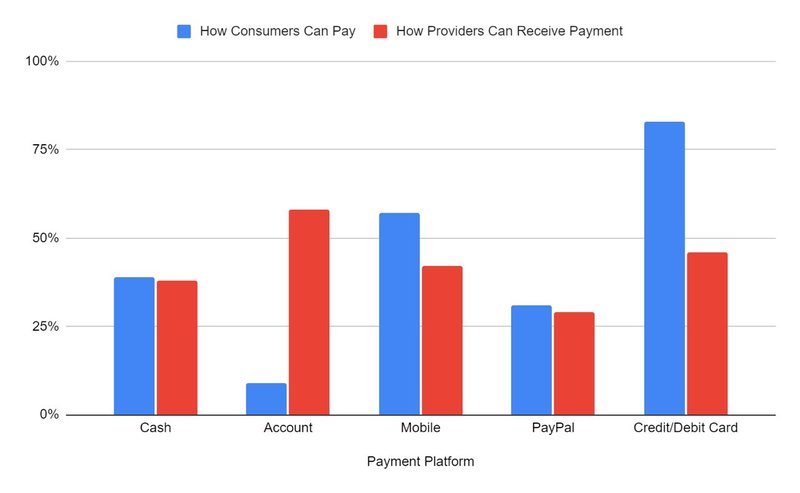

The chart above shows the payment methods accepted by digital platforms in Kenya as of 2018. It was created using the information provided by the Statista Research Department.

A payment gateway facilitates seamless e-commerce transactions by processing and managing transactions through secure payment services such as IntaSend. A payment gateway allows merchants to accept payments from various credit cards and bank accounts without building and managing their own in-house payment processing systems. Payment gateways are also an important part of an e-commerce business’s risk management strategy, as they help merchants safeguard their business from fraud and avoid the hassles of managing their own complex payment systems IntaSend has made it possible for small businesses and creative to get a payment gateway without company registration, and participate in the cashless economy.

Payment Gateway For Freelancers and Unregistered Businesses

It is no longer news that African freelancers usually encounter problems receiving payments, especially from international clients. This has been partly due to the lack of efficient options that allow freelancers to receive these payments easily. This is where IntaSend comes in. IntaSend understands the challenges freelancers face when receiving payments; hence the company has created different products that tackle these challenges directly, thus putting an end to payment problems for African freelancers. IntaSend is one of the best payment solutions for African freelancers, but that’s not where it stops.

IntaSend also understands how hard it is for unregistered businesses to receive payments due to the security issues involved. To solve this problem, IntaSend has created a special payment gateway for unregistered businesses to receive payments by only registering with basic identity verification, which is the best any unregistered can get from any payment provider. So if you run an unregistered business, you don’t have to live with the fear of not being able to receive payments any longer. You can get started with the easy steps we’ll be discussing below;

Step 1

To begin, you need to create an IntaSend account. Visit https://payment.intasend.com/account/signup/ to create an account. When creating an account, don’t forget to choose “Unregistered” as your business type, as this is the only way to access the features for unregistered businesses and freelancers. This means you won’t have to provide heavy documents for identity verification. You’ll only be required to fill in important details like your phone number, email address, government name, and basic identity documents. This is the key step for to get payment gateway without company registration. The support team will review the details provided and revert.

Step 2

Once you’ve created an account, you’ll have to wait a while (it doesn’t take long) for your documents to be verified and your account activated. Our support team will then schedule a call with to properly understand your business so that we are able to assist you properly.

As soon as your identity documents have been verified, your account will be activated by the IntaSend team, and you can start creating payment links to bill your clients. This is very easy as it doesn’t require you to integrate codes before you can get paid.

Just create a payment link and send it to the client via email or WhatsApp. The client will be redirected to the payment page once they click the link. They will see your preferred payment method and the amount they’re supposed to send you. This is one of the easiest ways to get your payments as a freelancer or unregistered business.

Step 3

Depending on the payment method, your funds may take up to 2 days to be processed, which is the best compared to how long it would take if you opted for PayPal or UpWork. Once your payments have been processed, you can enjoy IntaSend’s fast settlement. You can immediately withdraw to your M-Pesa wallet, which is made available instantly.

What Are The Benefits of Using IntaSend

Easy registration

Opting for IntaSend’s payment gateway for unregistered businesses and freelancers will be one of the best decisions you’ll ever make and the first step involved in journeying into the world of getting your payments easily from international clients. This product doesn’t exist with other payment providers; even if it does, it’s not always easy. With IntaSend, the best thing about this product is it's easy registration.

The first step, as mentioned earlier, is creating an account where you’ll get to choose “Unregistered” as your business type to have access to every feature for freelancers and unregistered businesses. You’ll be required to upload basic identity documents (mostly your national ID and passport). You should wait for a call from friendly support for a proper understanding of your business. This is one fo the easiest ways to get paid by local and international clients as a freelancer or owner of an unregistered business.

Multiple payment options

Your options for receiving payments are limitless (not literally). Other payment gateways provide a few ways for freelancers to collect payments from local and international clients. IntaSend offers various ways for freelancers and unregistered businesses, even without a website. You can use IntaSend’s invoicing system to create payment links, with several payment options to choose from. A unique link will be generated upon request for your clients to pay, after which you’ll be notified that the payment has been received successfully.

Card payments, ACH transfers, and payments with Bitcoin are some of the most popular ways to receive payments on IntaSend. IntaSend’s card payment feature supports MasterCard and Visa, while ACH lets your clients transfer money from US banks to Kenya. On the other hand, you can ask your clients to pay with Bitcoin, which will immediately reflect in your IntaSend wallet in USD. This option is also perfect if you’re requesting payment from a client whose only option is CashApp. You can ask them to send Bitcoin from their CashApp to your IntaSend wallet through a unique wallet address you will be given. These options are the best you can get with any payment provider.

Fast settlement

People love IntaSend because payments are processed faster than other known payment providers. Card payments take up to 3 days to clear, while ACH payments take about the same period. However, payments are instant if you’re withdrawing to your M-Pesa wallet. To withdraw your funds, go to your IntaSend dashboard and choose your preferred destination. Learn more about settlement options and how to withdraw funds from your IntaSend wallet here.

Managed chargebacks

With IntaSend, chargebacks are investigated fairly and correctly. The team shows enough transparency as you will be carried along through the process to ensure refunds and chargebacks.

Real-time notifications

One of the ways IntaSend carries its users along is to notify them of every payment they receive in real-time as soon as it comes in. This way, you can keep track of your transaction activities and keep a good record of the payments in case of future disputes.

How To Set Up An IntaSend Account

To access the payment gateway for freelancers and unregistered businesses, you need an IntaSend account. An IntaSend account is a pathway to enjoy these benefits, and creating one is not rocket science. Visit the signup page, fill in your details, and choose “Unregistered” as your business type. You will undergo a verification process where you’ll be required to provide basic identity documents like your national ID and passport. A call will also be made to confirm your business model. Once your account is activated, you can start creating payment links. You can send these links to your clients via WhatsApp, email, and Skype. Getting started on IntaSend is that easy!

Conclusion

Unregistered businesses and freelancers don’t often have the luck of collecting payments from clients and customers from anywhere worldwide because of the lack of credible and efficient options. This has caused some discouraging events over the years. You would argue that you could go through platforms like PayPal, Payoneer, or even Upwork if you’re a freelancer on the platform. However, besides charging a lot of money for transaction fees, PayPal is not available in most African countries. Payoner, on the other hand, charges a hefty sum as transaction fees, has a longer settlement period, and puts a lot of restrictions on users outside of America and Europe.

Upwork takes a whopping 20% for the first $500 you make on the platforms, after which you’ll be charged 10% for every dollar you make until you get to $10,000. The truth is they never stop charging you. This leaves you with IntaSend as the only credible option. IntaSend does not charge extra fees. Please visit our pricing page for more details. IntaSend also provides you with multiple ways to get your payments from local and international customers. If you’re a freelancer, having an account with IntaSend will be one of the best decisions you’ll ever make.

Cover Photo by Andrew Neel on Unsplash