Payments API for Developers - IntaSend

Aug 20, 2022

Payment gateways like IntaSend help businesses and developers to send and collect payments with ease. For example, IntaSend’s Payment API for developers can be used to integrate your app or website with one of the largest payment networks in the world to make it simple for your customers to pay with their checking account, debit card, prepaid card, or digital wallet.

Through our payments API , we see developers integrating payments into all kinds of apps and websites. Whether you’re an individual developer trying to get your first project off the ground or a team looking to expand your current services, integrating payments into your app or website has clear benefits.

I’m sure you know that mobile payments are growing rapidly. Consumers are using their smartphones more and more to buy things, pay bills, and manage their cash.

To support this trend, a lot of Payment APIs have recently been launched for developers to build new apps with convenient payment functionality. There’s no doubt that this is great news for users, because it means they have more choice and ease of use when paying. As an app developer or a software engineer who wants to add payments, you might be wondering what exactly these APIs do, which one is the best for your particular needs, and how you can use them in your projects. In this blog post we’ll explain everything you need to know about Payment APIs and share more details on what IntaSend provides.

Let’s begin.

What is a Payment API?

A Payment API is a set of tools that allows you to integrate online or mobile payments into your application. It’s an API that enables users to pay for products or services using their credit card, bank account, or any other payment method. Payment APIs are usually provided by third-party service providers and have different names, such as IntaSend, Stripe, Braintree, WorldPay, PayPal and many others.

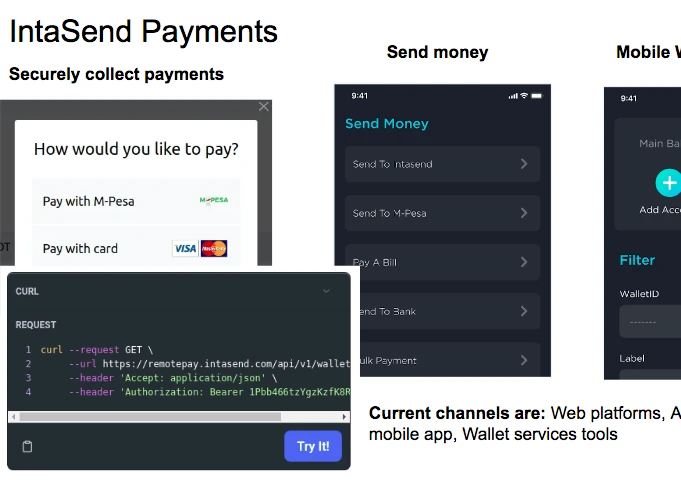

IntaSend provides a complete solution for accepting payments in the form of a Payment API that is easy to implement and scale as your business grows. IntaSend’s Payment API has been designed with developers in mind and allows you to build bespoke e-commerce solutions with access to all payment methods that we support: credit card, bank transfer and mobile.

How does it work?

IntaSend’s Payment API communicates with our payment gateway to process customer orders. The gateway is responsible for facilitating the payment process between your customers and the bank or credit card company.

Our Payment API supports the major card schemes, including Visa and Mastercard. You can use it to accept payments for a one-off project or integrate it into your e-commerce site to take regular orders via any of the supported methods. The payment API is available through RESTFul APIs and the payment handler API service.

What is a Payment Handler API

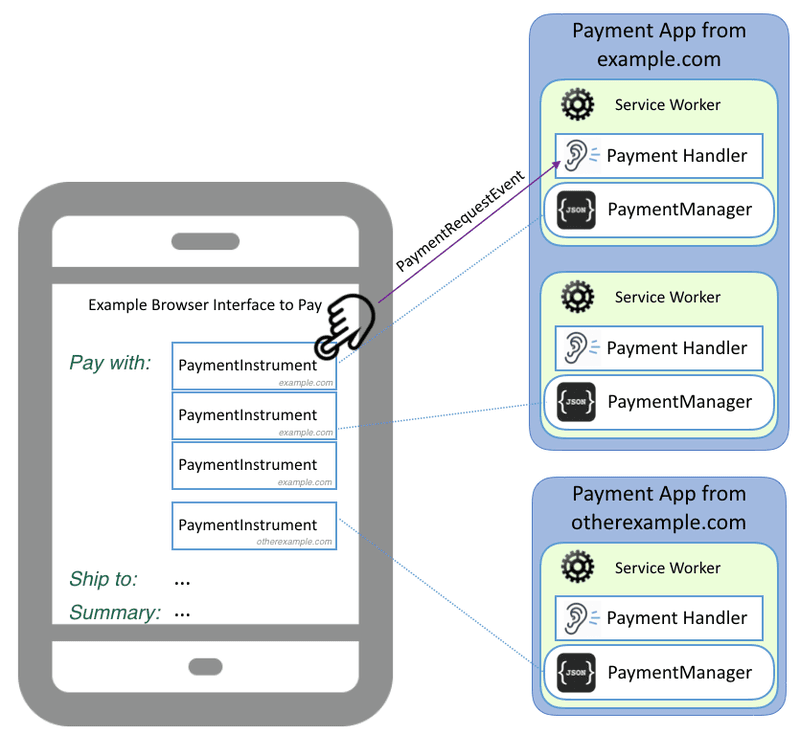

A payment handler is a Web application that can handle a request for payment on behalf of the user.

Payment handlers are responsible for accepting payments through their preferred form of payment, such as credit cards or bank accounts. They also manage recurring billing agreements with merchants, which can be automated via the API's API Gateway service.

In contrast, some payment methods, such as crypto-currency payments or bank originated credit transfers, require that the payment handler initiate processing of the payment. In such cases the payment handler will return a payment reference, endpoint URL or some other data that the payee website can use to determine the outcome of the payment (as opposed to processing the payment itself). The image below describe well how payment handler works.

Source - https://www.w3.org/

Why should you integrate a payment API?

The technology behind the integration of a payment API is simple. However, it can be challenging to get it right. Here are some reasons why you should integrate an API:

1) Easy Integration It is easy to integrate a payment API with your website. In most cases, you need only a few lines of code to add the functionality to your website. This includes no-code tools, SDKs, and platform apps such as the IntaSend Shopify App that does not require any coding.

2) Reduced cybersecurity risks - Payment gateways like IntaSend undergoes security checks such as PCI-DSS and have measures in place to protect merchants from risk of frauds and online hacks. Using a payment API protects you from these risks. The system is well tested and easy to plugin. This helps in reducing time to market.

3) Smart routing - Payment gateways work with various partners to ensure reliability. For example, IntaSend payment gateway connects to various payment partners and in case one of the partners network fails to process a transaction, we are able to route to another one to ensure customers have a good success rate and experience.

4) Managed refunds i.e refunds and chargebacks processing can be overwhelming. When using a payment API, the provider helps you in taking care of this and with minimal errors by automating the process.

5) Customized workflows - you are able to extend more functionality using the Webhook services e.g sending a receipt or second confirmation SMS

6) Many ways to pay - With a single API, you are able to give your customers many ways to pay.

How to choose the right API for your app?

Payment integration can benefit you and your users from a developer's perspective. You can enhance customer experience, streamline operations , and enhance security.

When faced with the vast array of payment APIs available for your business, it can be challenging to choose the right one, keeping API flexibility in mind. To ensure seamless integration, we have compiled a list of critical features developers should check when selecting a flexible payment gateway API.

Clear Documentation

Documentation is the most essential tool for implementing an API and therefore determines the quality of the integration experience. Documentation is one of the first things you should look at when evaluating payment APIs.

Does it convey information clearly and concisely? Is it included with a tutorial and sample code? What is its layout like, and how easy does it look? Before moving forward, ensure you have answered all these questions positively.

Up-to-date Design and User Experience

In addition to the payment gateway's design, the payment system's functionality is also essential. It is crucial to consider both the developer's professional vision and the customer's needs when designing an API interface.

Therefore, it should deliver basic technical functionality and incorporate modern design practices that work with usability, accessibility, and many other aspects that contribute to the user experience.

Easy to Use

We should emphasize usability concerning the previous point. An integration process that takes a long time and costs money is not worth wasting your time and money. An API that is quick, easy to implement, and simple is the easiest way to build a new application.

For the API to work correctly, it must be structured in a straightforward and consistent manner, and it should give clear error messaging when something doesn't work.

API Testing Environment

Before going live, you should test your API integration from the customer's perspective. This way, you can ensure that the web services will meet your requirements upfront and that everything works. For testing with dummy data, ensure that the payment API provides a sandbox or test environment.

Robust Security

It is crucial to ensure security when accepting payments. You and your customers should be protected from a data breach by choosing a payment API for developers that secures sensitive cardholder data during both the capture and storage processes.

A wide range of security features can protect transactions throughout their lifecycle, including point-to-point encryption (P2PE) and tokenization. Keeping data safe and compliant with PCI is achieved through CardConnect's patented security solution, which is PCI-validated.

Omni-channel Capabilities (Many ways to pay)

Integration with a processor that offers an omni-channel solution will allow you to give customers as many options as possible when making purchases. Customers will be more likely to purchase from your site if you offer multiple payment methods, including point-of-sale, mobile, online, or ACH.

Broad Functionalities

Authentication processes, error handling, data validation, or error handling are all necessary features in any API. Developers should consider tokenization when creating payment APIs and advanced features like charging or refunding customers and automating recurring payments.

By providing all the necessary functionality to your customers, you will be able to maximize their satisfaction.

Integration with Multiple Gateways

Payment gateway APIs that can connect to more than one gateway may be helpful in several situations. This happens more and more frequently nowadays, so developers should be aware of this option.

There may be a situation where your customer wants to expand to a new market, but their payment provider cannot accept payments there. A payment API for developers with such capabilities is needed in this case.

Third-party API Partners

You'll instantly grow your customer base if you can serve customers' needs. Many industries require third-party APIs - if you can meet their needs, you'll gain more customers. This is most common with businesses that offer different services purchased from various providers on their websites.

Payment gateway APIs should enable the processing of each transaction independently and directly with each provider. When everything goes according to plan during this third-party transaction, your merchant partner and its customer will experience seamless payments.

Customer Support

As a final consideration, the source of the payment API for developers must provide adequate support. Integration with APIs is a complex process, so knowing there is support available will give you peace of mind throughout the entire process.

IntaSend: A multi-platform and multi-currency payment API.

IntaSend API supports mobile, cards, and bank payments, as well as receipts and disbursements. Developers should be able to quickly, securely, and functionally integrate payments. IntaSend was developed for developers using all the experience and knowledge gained over the years of integrating payments.

The tools and technology we provide are designed to simplify your payment processes. Further, you can use IntaSend's payment collection tools without hosting a website or mobile app or hosting your own website. Send mobile money, IntaSend peer-to-peer transfers using IntaSend's transfer API. Authentication is required for the API, which is REST-based.

Receiving payments from foreign clients is easy with IntaSend. There is also the option to pay with bitcoin and with ACH (US bank transfers to Africa). As well as accepting all major credit cards and debit cards, it also accepts cash.

The client can select the payment method that is most convenient for them, so you give them several options. As a result, you are likely to have a higher success rate and revenue. Learn why Africans should choose IntaSend based on the features it offers.

Payment APIs

The payment APIs we provide will allow you to integrate multiple payment channels into your website, regardless of whether you are a freelancer or a business owner. IntaSend eliminates time and effort spent on development by integrating with multiple providers.

Both code-based and no-code applications can be integrated with the SDK developed. Therefore, IntaSend's payment system enables your site to be integrated with a wide array of options. Further, development teams can test their solutions in the test environment before they go live.

Highly Secure Payouts

It is important to handle international transactions securely. Despite their desire to keep money safe and secure, banks have always been easy targets for hackers. Once money has been stolen from the bank, there is no guarantee that it can be retrieved.

You are at risk of high-level security breaches due to the weak security policies and access policies of banks. Investing in institutions that have high financial security and risk management is more important for businesses and customers. Using IntaSend, you can disburse and collect cross-border payments quickly, securely, and in multiple ways.

MPesa API

The M-Pesa API makes it possible to automate mobile payments, send money, and collect money. Through multiple payment solutions, IntaSend ensures that your payment needs are met as quickly as possible. We support C2B (M-Pesa Express), B2C - Payouts and Disbursements, and M-Pesa B2B payments API.

Bitcoin Payments

With its robust technology, IntaSend also offers multiple payment options through its partnerships with industry leaders like Visa, Mastercard, and banks. As a result, you will have a higher chance of getting paid and you will not lose revenue due to customers not being able to pay.

Along with traditional online payment methods, clients can also choose to pay with cryptocurrency using the Pay with Bitcoin option. By automatically converting the collected amount to US dollars, IntaSend protects you from cryptocurrency price fluctuations. With our platform, you won't need to worry about crypto payments' liquidity issues.

Card Payments Transactions

You can accept card payments with IntaSend. When customers make a purchase using their PIN, they must authorize their purchase using 3Ds. In order to protect your business from chargebacks and fraud, authorization is needed to be strictly followed. By using the one-time PIN sent by the issuing bank, our system ensures the card owner approves the payment.

Further, the process of capture involves the transfer of funds from the customer's mobile wallet or card issuer to the IntaSend settlement account. Unlike card payments, mobile payments can be withdrawn instantly. Upon completing credit card processing and receiving a success status, a merchant can release goods/services. Funds are released for settlement within the clearing period when the card provider releases them.

ACH Transactions

An ACH transaction uses data files that contain payment information. In order to process a transaction, the file has to be sent to the bank of the originator, then funds have to be transported to the bank of the recipient through a clearing house, then to the bank of the recipient.

It is possible to transfer funds directly from the U.S. to Africa using ACH (bank transfers), which is ideal if you have clients in the U.S. You might like to use ACH to send funds to your clients in the U.S. You will incur the same charges as ACH payments and receive the funds within 2 to 3 business days, which will make the process much easier.

How do I use a Payment API?

To start using IntaSend’s Payment API you first need to sign up for an account . Once you have created an account you can apply for an API key . This key will be used in your applications to transmit data securely via HTTPS protocol. As soon as you have finished coding, test your integration by sending a test transaction with Sandbox Test Mode enabled. Once everything works well, send live transactions by switching Test Mode off (you don’t have to change any other settings). Your application is now ready for production! To make sure that everything works perfectly in production mode we recommend that you test it again after making some changes to avoid errors during real transactions.

Here is the link to our API Documentation and SDKs. Visit our GitHub page to access our open-source SDK and tools - https://github.com/intasend

Wrapping Up

By integrating the multiple APIs into your application, you can make payments, pay bills, send money, or collect money from other users without any hassle. It is imperative that your application accepts multiple forms of payments. The purpose of IntaSend is to help you reach your goals in making international payments. It was designed by developers for developers. Check out how we can help you as a developer.