How to Pay NHIF Contributions Via M-Pesa - The Ultimate Guide

Dec 29, 2022

Paying your NHIF contributions on time every month protects your medical insurance coverage. Learn how to pay NHIF through M-Pesa and never miss a payment.

Did you know that there are penalties for missed NHIF payments, even if you delay payment by 1 day? You have to pay 50 percent of your monthly contribution as a penalty for every month you did not pay your contribution.

And you will still have to pay the regular subscription for all those months you did not pay. If you default on your NHIF contributions for a full year, your cover will expire. To reactivate your policy, the NHIF has to treat you as a new member, which means you have to wait 3 months for your cover to become active.

You really don’t want to fall sick with your NHIF in arrears, especially when they have made it so easy and convenient to pay your contributions.

Not sure what the NHIF payment procedure is?

In this article, you will learn how to pay for NHIF via M-Pesa so you never have to miss a payment because you were busy or out of town.

How to Pay NHIF Contributions

The National Health Insurance Fund (NHIF) is a medical insurance scheme for Kenyan citizens that is run by the government of Kenya. To maintain cover, registered NHIF members must pay contributions before the 9th of the following month.

The NHIF has provided 3 ways for members to pay their monthly contributions. These payment options are:

M-Pesa

Bank deposits

Safaricom Bonga points.

NHIF members can deposit their monthly contributions at the bank. Some of the banks at which you can deposit your contributions are Equity Bank, Kenya Commercial Bank, and Cooperative Bank. There are NHIF-printed deposit slips at these banks.

If you use a Safaricom mobile phone line and have accumulated a nice Bonga points haul, you can redeem those points and use them to pay your NHIF premium through a menu on your mobile phone.

But perhaps the most convenient way to pay NHIF contributions for most Kenyans is via their M-Pesa mobile wallets. M-Pesa is the digital savings account of choice, which most Kenyans find most convenient for paying for goods and services.

How to Pay NHIF Via M-Pesa

The easiest way to pay for NHIF contributions is via M-Pesa, a mobile wallet service run by the Safaricom company, a mobile cellular network operator.

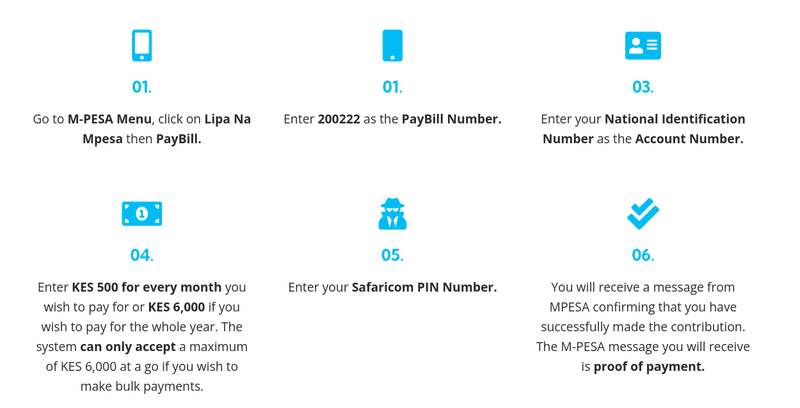

If you're enrolled in the National Health Insurance Fund (NHIF) medical insurance scheme, below is the step-by-step guide on how to pay your monthly subscriptions via M-Pesa:

1. Open the M-Pesa menu on your mobile device

To open the M-Pesa menus, dial *384#. Click on Lipa Na M-Pesa. A menu with various M-Pesa services and options will appear.

2. Select "NHIF" from the menu.

This will bring up the NHIF payment options. Select the Pay Bill option.

3. Enter the NHIF pay bill number

The NHIF pay bill number is 200222. This will allow you to make a payment to NHIF using M-Pesa.

4. Enter your NHIF number as the account number.

Your Kenyan national identification number is your NHIF account number. Make sure you enter it correctly as that will ensure your payment is credited to your NHIF account.

5. Enter the amount you want to pay.

Insurance contributions amounts are subject to change. So make sure you know how much your current monthly contribution is. Check with both Safaricom and NHIF for the most up-to-date fees and charges.

And be sure to double-check the amount before proceeding to avoid underpayment penalties and maintain your cover.

6. Confirm your details and enter your M-Pesa PIN.

You will be asked to verify the transaction, so check to see if your national ID number and the amount you have entered are correct.

You will confirm that all is as should be and authorize the transaction by entering your PIN. This will complete the transaction and transfer the payment to your NHIF account.

It's worth noting that there may be fees or charges associated with making an NHIF M-Pesa payment. Safaricom, the company that provides M-Pesa, typically charges a small fee for M-Pesa transactions. NHIF may also charge a processing fee for payments made through M-Pesa.

Despite your best plans, sometimes you will miss your NHIF payments. When that happens, you want to make good on your payments and keep your account clean. Unfortunately, that means paying a penalty.

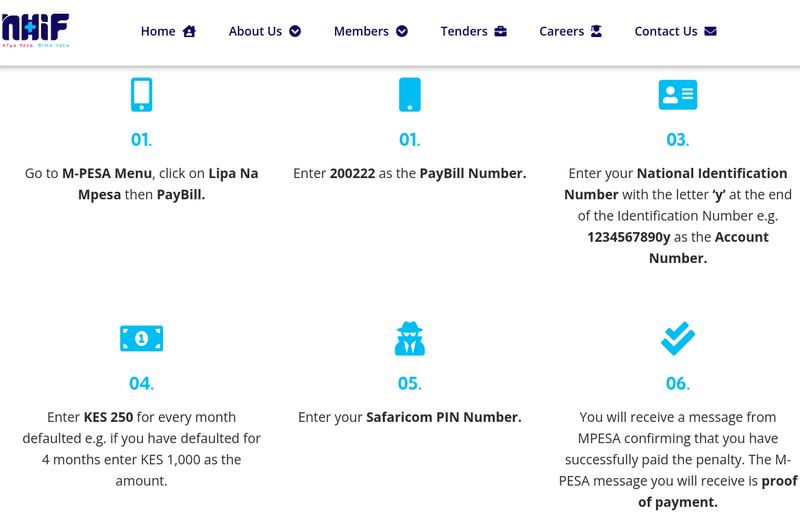

How to Pay NHIF Penalty Through M-Pesa

NHIF payments have to be made before the 9th of the next month. Missing the payment will attract a penalty that amounts to 50 percent of your regular monthly contribution.

Just as with regular monthly contributions, you can pay an NHIF penalty through M-Pesa. Here are the steps to follow:

1. Open the M-Pesa menu on your phone

To open the M-Pesa menu, dial *384# to open the M-Pesa menu. Click on Lipa Na M-Pesa.

2. Enter the pay bill

The NHIF bill number for M-Pesa is 200222.

3. Enter your account number

Your national ID number is your NHIF account number. But for NHIF penalty payments, you have to suffix that number with the letter Y. So if your ID number 1526647782, you will enter is 1526647782y. That letter y is what identifies the payment as a penalty.

4. Enter the penalty amount

The monthly NHIF contribution currently stands at Kes.500. The penalty is half of that monthly subscription, which in this case will be Kes.250. That is the amount you will enter.

If you have missed more than one month, you have to multiply the penalty amount by the number of months you have missed. That means if you have defaulted for 3 months, the penalty amount will be Kes.750.

5. Confirm your payment

The M-Pesa app will return a message asking you to confirm the transaction. Review the transaction details and ensure they are correct. Entering your M-Pesa PIN confirms the penalty payment.

How to Register for NHIF Medical Insurance Scheme

The NHIF medical insurance scheme is an effort by the government of Kenya to ensure every Kenyan can access quality health care. That commitment is evident in the NHIF’s efforts to simplify the registration process.

Here are the steps to follow to register for NHIF medical insurance coverage:

1. Determine your eligibility

Only Kenyan citizens or residents of Kenya who have valid work permits can register for NHIF. You must also be at least 18 years old to register as an individual or head of household, or at least 16 years old if you are registering as a dependent.

Get the necessary documents

Next, you have to gather the necessary personal and identification documents. This may include your national ID card, passport, birth certificate, or work permit, as well as proof of residence. Depending on the type of coverage you seek, you may also need to provide proof of income or employment.

2. Choose a plan

NHIF offers a range of coverage options, including plans for individuals, families, and small businesses. Choose the plan that best meets your needs and budget.

NHIF plans are designed to cover the basic needs of most individuals and families and can be customized to fit your lifestyle. You can also add coverage for dental, vision, and other classes of medical care that may be important to you.

When choosing a plan, consider the cost, coverage levels, and the benefits offered. Compare different plans to find one that offers the best combination of benefits for your family or business.

3. Submit your application

There are several ways to submit your NHIF registration application, including online, by phone, or in person at an NHIF office. If you are submitting your application online or by phone, you'll need to attach your personal and identification documents as well as your chosen plan and payment information.

If you are submitting your application in person, you'll need to bring all of these documents with you to the NHIF office. It is important to bring the correct documents and ensure that all the information is correct. Submitting incorrect or incomplete information can result in delays in processing your application.

4. Pay your premiums

Once your application has been approved, you'll need to pay your premiums in order to activate your coverage. Premiums can be paid through a variety of methods, including cash, check, or bank transfer. You can also pay your premiums using M-Pesa, which is the most convenient way to pay.

5. Register your dependants

If you have any dependents you want to be covered under your NHIF plan, you'll need to register them separately. You need to submit their personal and identification documents, as well as proof of your relationship with them.

This information is essential for the NHIF to assess their eligibility for coverage. You are also mandated to notify the NHIF of any changes in your dependent's circumstances such as marriage, divorce, or relocation.

Failing to notify the NHIF of any changes so in your dependents’ marital status may jeopardize their coverage.

6. Obtain your NHIF card

Once you have completed the registration process, you'll receive an NHIF card in the mail. This card serves as your proof of coverage. You should have your NHIF card on you at all times in case you are in an accident that calls for a hospital visit.

If you need to change any of your personal details, you have to visit the NHIF offices. Healthcare facilities will not be able to change your details for you.

Advantages of Paying NHIF Contributions Through M-Pesa

There are several advantages to paying your NHIF contributions through M-Pesa. Below we run through some of them:

1. Convenience

M-Pesa allows you to make NHIF payments from anywhere, at any time. All you need is your mobile device and network coverage. This is particularly useful if you don't have access to a bank or can’t visit a bank or NHIF office in person.

2. Easy record-keeping

M-Pesa automatically records all your payments, so you don't have to worry about keeping track of receipts. This makes it easier for you to track your NHIF payments and stay up to date with your coverage.

3. Cost savings

Making NHIF payments through M-Pesa is often more cost-effective than other payment methods, as it eliminates the need for you to travel to a bank or NHIF office and pay additional fees for services.

4. Security of payments

M-Pesa uses advanced security technology to protect you from fraud and identity theft. It also uses advanced encryption technology to ensure the safety and privacy of your transactions.

M-Pesa has an integrated digital identity system, which verifies customers when they sign up, making it difficult for fraudsters to create fake accounts.

The system is regularly audited and tested to ensure all transactions are secure and potential risk areas are identified and addressed promptly. This makes M-Pesa one of the most secure mobile payment systems available today.

5. Ease of use

M-Pesa is easy to use, even if you are not familiar with mobile banking. The process is straightforward and requires only a few simple steps. First, you have to register for an M-Pesa account.

The process to pay NHIF using M-Pesa should take no more than five minutes. You are only asked to provide your personal information, such as your name, address, and phone number, all of which are easy to remember.

Once registered for M-Pesa, you can use the M-Pesa app to transfer money from your bank account to another account or to your M-Pesa balance. You can also receive money from other users and use the app to pay bills or buy things online.

Use IntaSend to Receive and Manage Your Payments and Keep Your M-Pesa Fully Funded

Paying NHIF contributions through M-Pesa is easy and straight. And just as well as, of all your financial commitments, it’s essential that your medical insurance policy is clean and up-to-date.

Do you run a local business or offer freelance services and need a secure digital wallet to receive and send payments, process your money transfers, and manage your finances?

IntaSend is your all-in-one solution, with robust tools and advanced analytics and reporting capabilities that guarantee the security of your funds. We support Mastercard, Visa, bank, and M-Pesa payments, which ensures you convenient, 24-hour access to your money.

Sign up for an IntaSend account today and enjoy quick, hassle-free money transfers and business payments.