Money Transfer Services - The Best in Kenya

Money transfer services in Kenya have come a long way in recent years, with several companies offering a range of options for sending and receiving money both domestically and internationally. In this article, we will delve into the history of money transfers in Kenya, as well as take a look at some statistics and trends in the industry.

The first money transfer services in Kenya can be traced back to the 1990s, with the introduction of companies like Western Union and MoneyGram. These companies operated through a network of agents located in towns and cities across the country, allowing individuals to send and receive money internationally.

In the early 2000s, the Kenyan government introduced new regulations to oversee the money transfer industry, with the Central Bank of Kenya (CBK) issuing licenses to companies that met certain requirements. This led to the entry of new players into the market, such as Ria and Xpress Money, which also offered international money transfer services.

Over the past decade, there has been a shift towards digital money transfer services in Kenya, with the proliferation of mobile phones and the increasing use of mobile banking services. Companies like M-Pesa, a mobile money service launched by Safaricom in 2007, have become popular among consumers, as they offer an easy and convenient way to send and receive money using a mobile phone.

According to data from the CBK, the value of money transferred through digital channels in Kenya reached KES 1.95 trillion ($18.6 billion) in 2020, representing a significant portion of the country's GDP. This trend is expected to continue in the coming years, with the CBK estimating that the value of digital money transfers will reach KES 3.5 trillion ($33.7 billion) by 2025.

In addition to traditional money transfer services, there are also a number of online platforms that allow individuals to send and receive money internationally. These platforms, such as PayPal and TransferWise, offer competitive exchange rates and low fees, making them a popular choice for many people.

The money transfer industry in Kenya has come a long way in recent years, with a range of options available for sending and receiving money both domestically and internationally. From traditional money transfer companies to digital platforms, there is a solution for every need and budget.

What Makes a Good Money Transfer Service?

Low fees

One of the most important things to consider when choosing a money transfer service is the fees that are associated with the service. After all, nobody wants to pay high fees just to send money to a loved one or pay a bill. A good money transfer service should have low fees for transferring money, both domestically and internationally. This ensures that the sender and recipient are able to maximize the amount of money that is transferred and received. And let's be real, who doesn't love a good deal? Low fees ensure that customers can fully focus on the most important part of the money transfer, which is the reason for the transfer, without worrying about heavy fees that can easily make the transfer less enjoyable.

High exchange rates

Another crucial factor to consider is the exchange rate that is offered by the money transfer service. If you're sending money internationally, the exchange rate can have a big impact on the amount of money that the recipient ends up receiving. A good money transfer service should offer competitive exchange rates so that the recipient is able to receive as much money as possible. No one wants to feel like they're getting shortchanged, which is why it's important to do your research and compare exchange rates before you send your money abroad.

Fast transfer times

When you need to send money, chances are you need it there as soon as possible. Whether it's to cover an unexpected expense or to help out a loved one in need, fast transfer times are essential. A good money transfer service should be able to transfer money quickly and efficiently so that the recipient is able to access the funds as soon as possible. No one wants to be left waiting around for their money to arrive. You want a reliable money transfer company that can help you with this. A good company will make this happen and will do so in a way that will suit your needs.

Multiple payment options

It's always helpful when a money transfer service offers a variety of payment options, as this makes it easier for the sender to initiate the transfer and for the recipient to access the funds. Options such as bank transfers, debit or credit card payments, and mobile payments are all great choices. Having multiple payment options also means that you have more flexibility and can choose the option that works best for you. In other words, a good money transfer service must offer flexible payment options.

Easy-to-use platform

Nobody wants to use a service that is confusing or difficult to navigate. A good money transfer service should have a user-friendly platform that is easy to understand and use. This makes it easy for both the sender and recipient to use the service, even if they aren't the most tech-savvy individuals. After all, the whole point of a money transfer service is to make things easier, not more complicated. At the end of the day, everyone wants ease, and the money transfer service we use to send payments should be no different. This must be one of your many considerations when choosing your ideal money transfer service.

Availability

If you're sending money internationally, you'll want to make sure that the money transfer service you're using is available in the country or region where the recipient is located. A good money transfer service should be available in a wide range of countries and regions so that it can be used by a diverse group of people. This is especially important for international transfers, where the service should be able to support a variety of currencies. Again, you must also consider transfer time, associated fees, and the exchange rate offered by the service.

Strong security measures

With all of the personal and financial information that is involved in a money transfer, it's important to make sure that the service you're using has strong security measures in place. This includes things like encryption, secure servers, and fraud prevention tools. You want to make sure that your information is protected and that you can trust the service you're using. Security should be very high on your list of priorities when looking for a money transfer service that suits your needs, and you shouldn't make any compromise for any reason when it comes to this because a lot is at stake.

Customer support

Even the best money transfer services can have issues or encounter problems from time to time. That's why it's important to choose a service that has a reliable customer support team that is available to help users with any issues or questions they may have. Whether it's through phone, email, or live chat, having access to a knowledgeable and helpful customer support team can make a big difference. You can easily reach out to them through any of the aforementioned channels and get a quick response or any tip that can help you with your money transfer needs.

Get Familiar with IntaSend

Without a doubt, IntaSend is one of the biggest digital payment providers in Kenya and has gained widespread popularity due to its impressive features, which include a fast and secure online payment service, several payment APIs for developers, and many others. Having recently been founded in 2019, IntaSend has quickly gained popularity and recognition as a convenient and easy-to-use online payment service in Kenya and some parts of East Africa. With its features, IntaSend can go toe-to-toe with some of the biggest names in the industry unscathed. IntaSend has a high success rate and many positive reviews from both regular users and big companies who have all witnessed the company’s effectiveness firsthand. So, why do people hold IntaSend in such high regard? Let’s find out below.

Bank-level security

It is important to note that no payment processing service can guarantee 100% security. However, by adopting strong security measures and complying with industry standards such as PCI-DSS, IntaSend can provide a high level of security for its users and help to reduce the risk of data breaches.

IntaSend aims to provide bank-level security for its users. It is important for payment processing services to have strong security measures in place to protect the sensitive financial information of their users. To achieve bank-level security, IntaSend uses various measures such as encrypted connections, secure servers, and strict access controls.

In addition to these security measures, IntaSend also complies with the Payment Card Industry Data Security Standard (PCI-DSS). This is a set of security standards designed to ensure that all companies that accept, process, store or transmit credit card information maintain a secure environment. Compliance with PCI-DSS can help to reduce the risk of data breaches and protect the sensitive financial information of users.

Multiple payment options

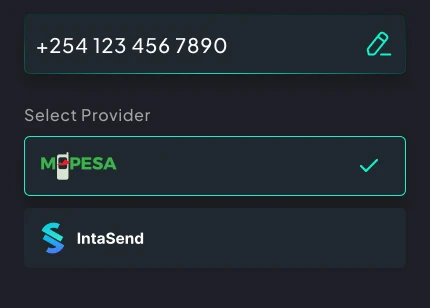

Making payments should be simple and stress-free, and that's exactly what IntaSend aims to provide. As a payment platform, IntaSend offers users a range of payment options, so you can choose the one that works best for you and your financial situation.

For example, if you prefer the convenience and security of using a credit or debit card, IntaSend allows you to easily make payments using these methods. Or, if you'd rather make a direct bank transfer, IntaSend makes it easy to do so. IntaSend also offers ACH and Bitcoin payments, making it very easy for users to choose the payment method that best suits their financial situation.

In short, no matter how you prefer to pay, IntaSend has got you covered. The platform is designed to be convenient, secure, and flexible, so you can make payments with confidence and ease. So the next time you need to send a payment, consider using IntaSend to make the process as simple and hassle-free as possible.

Business payments

IntaSend offers a range of solutions for businesses, including the ability to make B2B invoice settlements and bulk payment disbursements.

With IntaSend, businesses can easily pay invoices from other businesses, streamlining the payment process and ensuring that all parties are paid promptly. This is particularly useful for businesses that have multiple invoices to pay on a regular basis, as it saves time and reduces the risk of errors.

IntaSend also offers the ability to make bulk payment disbursements, which is useful for businesses that need to make payments to a large number of recipients at once. This could include paying employees, contractors, vendors, or other partners. With IntaSend, businesses can easily make these payments using a variety of methods, including credit and debit cards, bank transfers, and wallet payments.

IntaSend is an excellent choice for businesses looking to streamline their payment processes and make it easier to pay invoices and disburse payments to a wide range of recipients.

No-code payment links

IntaSend offers a special way for individuals and businesses to receive payments without the need for programming or coding knowledge. This particularly makes it easier for users to accept payments, especially if they do not have the technical skills or resources to set up their own payment processing systems.

In general, payment links can be a useful tool for businesses and individuals who want to receive payments online, as they allow users to make payments through a simple link, rather than requiring the use of a complex payment form or system. Payment links can be sent through email, text message, or social media, and can be used to accept a wide range of payment methods, including credit and debit cards, bank transfers, and mobile payments.

Feasible KYC

KYC, or Know Your Customer, is a process that involves verifying the identity of a customer or client and ensuring that they are who they claim to be. This process is often used by financial institutions and other organizations to comply with regulatory requirements and prevent fraud.

A feasible KYC process is one that is able to be carried out effectively and efficiently, without causing undue burden or inconvenience for the customer. A feasible KYC process may involve the use of automated systems and digital tools to verify identity, as well as the ability to accept a range of different types of identification documents.

It may also involve clear and concise instructions for customers on how to complete the KYC process, as well as the availability of support or assistance if needed. A company like IntaSend ensures that it is able to comply with regulatory requirements while also providing a smooth and convenient experience for its customers.

Conclusion

In conclusion, it is clear that IntaSend is a leading provider of money transfer services in Kenya. With its range of innovative features, such as no-code payment links and a feasible KYC process, IntaSend makes it easy for individuals and businesses to send and receive payments, both domestically and internationally. The company's commitment to providing excellent customer service and its use of advanced technology ensures that its users can enjoy fast, reliable, and secure money transfer services. Whether you are a business owner looking to streamline your payment processes or an individual seeking a convenient way to send money to friends and family, IntaSend is the ideal choice. Overall, it is no wonder that IntaSend is widely regarded as the best money transfer service in Kenya.