How to Report M-Pesa Fraudsters

Jun 18, 2023

Victims of M-Pesa fraud must quickly get over their shock and notify Safaricom to avoid further losses. Learn how to report M-Pesa fraudsters and protect yourself and others.

At least half of the people using the M-Pesa mobile money service in Kenya have lost money to fraudsters. That translates to 16 million people, roughly a third of the country’s population.

Imagine if all these people had reported the mobile numbers of those who scammed them!

That alone will not stop M-Pesa scams but will make it harder for scammers to operate. You can bet it will also lead to the arrest of some of them. The fewer scammers on our streets, the safer we all are.

So how do you report M-Pesa fraudsters?

Stick around, and you will find out.

How to report M-Pesa fraudsters.

Given the high M-Pesa fraud statistics in Kenya, there is a chance you have fielded a phone call or received an SMS from a scammer trying to trick you into revealing your M-Pesa PIN.

Some M-Pesa fraudsters will attempt to deceive you into sending them money from your mobile wallet. In other instances, they will trick you into authorising an ATM withdrawal from your M-Pesa wallet.

In most cases, the fraudsters will pose as M-Pesa employees. But whoever they claim to be or whatever they cite as the reason for their call, if they ask for your PIN or to perform a USSD action on your mobile phone, know that they are a scammer.

A very common M-Pesa trick is SIM swap, where the fraudster will call and claim that your SIM was somehow registered to two people. They will ask for your M-Pesa PIN, among other details, and then ask you to switch your phone off.

Unbeknownst to you, that is all the information they need to request a new SIM under your name and subsequently steal from your M-Pesa.

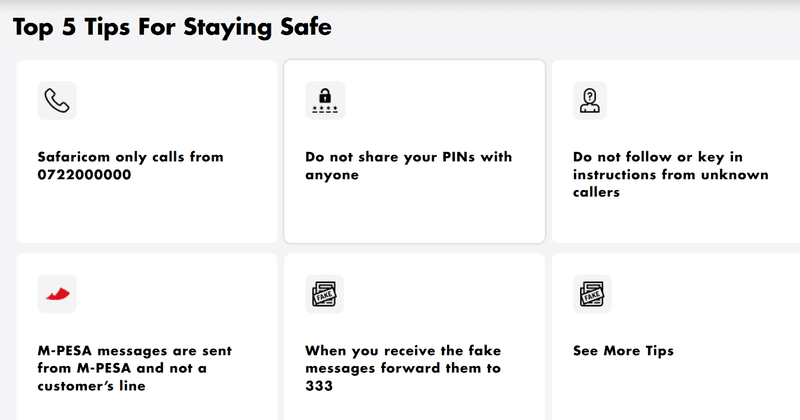

Safaricom will NEVER call and ask you for your PIN, and certainly not over the phone. They will be the first to tell you never to share your PIN with anyone. The scammers are getting increasingly sophisticated and are always coming up with new cons, so it’s best to be vigilant.

As soon as a caller asks for your M-Pesa PIN - no matter how reasonable their request sounds - hang up and immediately report the number. You should report all fraud cases, whether you lost money or were vigilant enough to stop the fraud.

Here are the ways you can report the M-Pesa fraudster:

1. Contact Safaricom customer care.

Safaricom advises you to contact their customer care department if you suspect an approach made to you was a scam. If you notice unauthorised withdrawals or transfers from your account, you must contact Safaricom immediately.

You can contact Safaricom customer care in several ways: ● Call their chargeable customer care number, 0722000000. This is the Safaricom number to report conmen and the only number the telco will ever call you on, but never to ask for your PIN, balance, the last few transactions you performed, or one-time passwords.

Call their toll-free numbers. If you are a prepaid subscriber, call 100. Post-paid customers must call 200 to talk to a support person for free.

Send a DM on social media on these official handles - Facebook, Twitter, and Instagram.

In the message you send through the above channels, include every detail about the scam or fraud. Explain how the scammer contacted you - the number they used to call or text, the email address, or the social media handle they used. Do not leave any detail.

2. Send a message to 333

Safaricom has a number to send SMSs to report M-Pesa fraudsters. Reporting the fraud or scam to this number helps mark it from the daily thousands of queries Safaricom receives.

Again, include every detail about the fraud and anything that can identify the M-Pesa fraudster. Safaricom will investigate the case and may even decide to block the number from the network to stop the scammer.

3. Make a police report.

Reporting M-Pesa fraudsters to Safaricom will ensure the numbers they are using are flagged and taken off the network. You have to take the step even if they failed in scamming you. If they have, it becomes a criminal matter that has to be reported to the police.

You can call the police’s toll-free phone lines, 900 and 911, to report the M-Pesa fraudster. It’s even better if you can go to the nearest police station. The police can record your statement and ask you for more details to track and apprehend the fraudster.

If you are not satisfied with how the police have handled your matter, you can escalate it to the Directorate of Criminal Investigations (DCI). This police unit is specially trained and equipped to deal with financial crimes.

The DCI has a toll-free number, 0800 722 203 you can call if you don’t have airtime in your phone. Otherwise, you can call them on 020 720 2000 and 020 334 3312. You can also visit their website to find other ways to report.

Lastly, if you feel your case has not been treated with the seriousness it deserves, you can report the M-Pesa fraudster to the Communications Authority of Kenya (CAK). The CAK is a state agency constitutionally mandated to investigate and act on such complaints. Call the CAK on their toll-free number, 0800 222 333.

Transact conveniently with M-Pesa but secure your main funds with IntaSend

Practically every merchant and anyone who wants to get paid accept M-Pesa. The mobile money wallet service has over 30 million users in Kenya. So in terms of convenience M-Pesa is unbeatable.

Regarding the security of your funds, M-Pesa accounts are too vulnerable. Even if they weren’t, the mobile wallet is such a magnet for scammers and fraudsters you can never feel confident enough to use it as your savings account.

The sheer frequency of M-Pesa scams means storing all your money in a mobile wallet is unsafe. The safer approach is to transfer only enough money to perform a transaction and keep the rest in a digital account with convenient access and, importantly, more robust security features.

IntaSend is a digital wallet and payment provider all rolled into one. Perfect for freelancers, with bank-level security features that safeguard your account and funds from unauthorised access and theft, you can manage your savings, pay, and get paid through your IntaSend account.

IntaSend allows you to withdraw to your bank account and your M-Pesa. IntaSend allows you to request a virtual Mastercard or Visa card in minutes if you shop online. A virtual debit card makes it easier to protect your details from scammers because it is not physically existing.

Sign up for an IntaSend account today and enjoy safer, smoother, and faster payments, whether you are the one paying or getting paid.