Digital Wallets APIs - The Future of Payments and Interoperability in Africa

Nov 12, 2022

This article will discuss the current condition of payment and the future payment systems in Africa and why we believe digital wallets APIs are at the most important component of it.

An overview of payments in Africa

Most of the people of Africa have low computer literacy and they are less likely to hold bank accounts. According to the data from 2010, only 10% of the Egyptian population had bank accounts, 4% of them contained Debit cards and less than 2% had Credit cards.

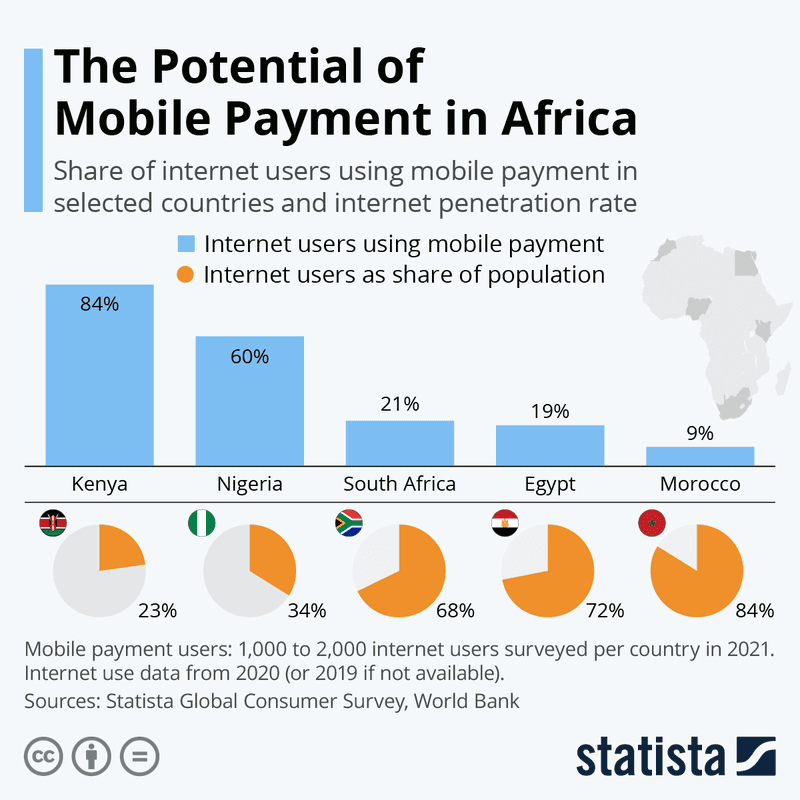

According to the Statista Global Consumer Survey report for the potential of mobile payment in Africa, only 9% of the total internet users in Morocco use Mobile payment and in South Africa, this number is 21%. Among them, Kenya holds a good position with 84% of Mobile Payment users. This is because most of the area in Africa has low internet capability and weak telecommunication systems.

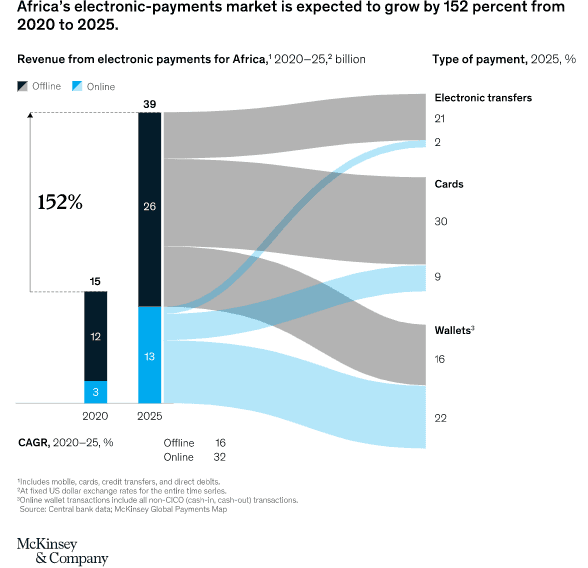

In 2020, Africa generated approximately $24 billion in revenue from domestic and cross-border payments. Now 5% to 7% of all transactions are made by using digital payment systems. From the below image data, we can see that the expected growth of the Electronic Payment Market in Africa is around 152% between 2020 to 2025.

Why Digital Wallet API is important in Africa

For any business today, e-payment is very important. Imagine that you are willing to start a fintech startup. If you don't have an e-payment system, you may just be able to start it from scratch and that is time consuming and expensive. But if you have a wallet api system in business, you can spread your business around the world by building on top of an already tested solution.

Digital wallets enable businesses to get paid and it is a very important for online businesses. Besides, it's a major requirement to get customers internationally. If we see the top-level e-commerce business that provides their services worldwide. All of them contain digital payments to receive payments from customers.

Besides, Wallets API is an important component of remittance. Africans in 2020 exchanged almost **$500 billion** via mobile money providers. For Africa to grow, there is a need for payment interoperability i.e payments systems should be able to connect with each other to facilitate payments and convenience. We believe this can only be done through digital wallets.

Finally digital wallets API promote financial inclusion. There is still a need to digitize payments for the unbanked. Today, 70% of the adult population in Kenya still do not have a bank account and this seems it will not change any time soon. The majority of the population relies on mobile payments which are basically digital wallets and APIs that work together to facilitate payments.

Best Digital Wallets in Africa

Now we are going to see the best Digital Wallet service providers in Africa.

IntaSend

IntaSend offers wallets as a service API to customers, developers, and businesses. IntaSend provides a suite of products and services for developers, which includes a platform for building, testing, and managing digital currency-based applications on the IntaSend network. IntaSend provides a suite of tools for building and executing payment flows on the IntaSend network, including a payment console for building and testing payments, a balance API for accessing a digital currency balance, and a secure messaging API for sending over-the-air transaction notifications. The platform also offers a suite of developer-focused services including a set of APIs (wallet as a service and payments API) for building digital wallets. For more details visit IntaSend homepage and Wallet As A Service API - 9 Best Use Cases.

MTN Mobile Money

MTN Mobile Money is a fintech platform that provides digital financial services to consumers and businesses. It enables users to access payments, e-commerce, insurance, remittance, and lending services. MTN Mobile Money contains 56.8 Million users. MTN stands out among mobile wallets in Africa for name recognition and adoption. It provides services in Rwanda, South Africa, the Republic of Congo, and at least 22 other countries in Africa and the Middle East.

Orange Money

Orange Money is the mobile wallet service that is available in most of the group affiliates in Africa. Through this payment method, its users can deposit their money into an account that is connected to their phone number. It provides a range of financial services. It provides money transfer services both locally and internationally. Besides they contain easy wallet integration through which you can easily integrate a payment system in the website or app you developed.

M-Pesa

M-Pesa is a mobile phone-based service for transferring money, financing, and microfinancing. It allows its users to transfer, deposit or withdraw money digitally. It is the most successful mobile phone-based financial service in the world. The M-Pesa API provides an open interface maintained over standard protocols through web services. It is easy for developers to integrate the core M-PESA in any system they build. M-Pesa provides you with some exciting features like Automated Payment Disbursements, Automated Payment Reversal, etc.

Conclusion

E-payment or Digital payment is a safe way to pay today. It provides you with security and protects you from fraud. It makes it easy to get paid by customers around the world. From the perspective of business, it is efficient and reduces costs.

By receiving or sending payments, you can track each of your transactions. Digital payment providers like IntaSend provide you high level of security and transparency on each transaction that makes it easy for your financial management. A digital payment system increases the stability of a financial system. For a country, it can be a powerful tool for promoting economical growth.

References

https://www.bankservafrica.com/website/about-us/future-of-payments

https://techcabal.com/2021/10/28/the-future-of-payment-in-africa/

https://www.mckinsey.com/industries/financial-services/our-insights/the-future-of-payments-in-africa

https://www.weforum.org/agenda/2022/03/mobile-payments-africa-covid-pandemic/

https://ecommpay.com/products/payment-methods/payment-systems-in-africa/

https://blog.remitly.com/finance/popular-mobile-wallets-around-world/

https://thefintechtimes.com/using-mobile-payments-and-wallets-in-africa/